Representative picture. Hindustan Petroleum Outlet | Commons

Text size: A- A +

New Delhi: Gasoline prices have surpassed 100 rupees per liter in several Indian cities in recent weeks, fueling inflation and putting pressure on household budgets.

While the rise in gasoline and diesel prices can be explained in part by rising international fuel prices, the high taxes on these products also play an important role. Another factor is the two-month freeze on fuel price increases in the election months of March and April.

The Narendra Modi government has so far resisted lowering taxes on petroleum products, despite the Monetary Policy Committee (MPC) chaired by the Governor of the Reserve Bank of India urging the center and states to lower these taxes to ease inflationary pressures to reduce the economy.

ThePrint explains why fuel prices rose in May.

Tax effect on the oil price

India meets its domestic oil needs primarily through imports. While international crude oil prices have risen sharply in the past six months, a major reason for the high retail price of gasoline is the high level of local taxes.

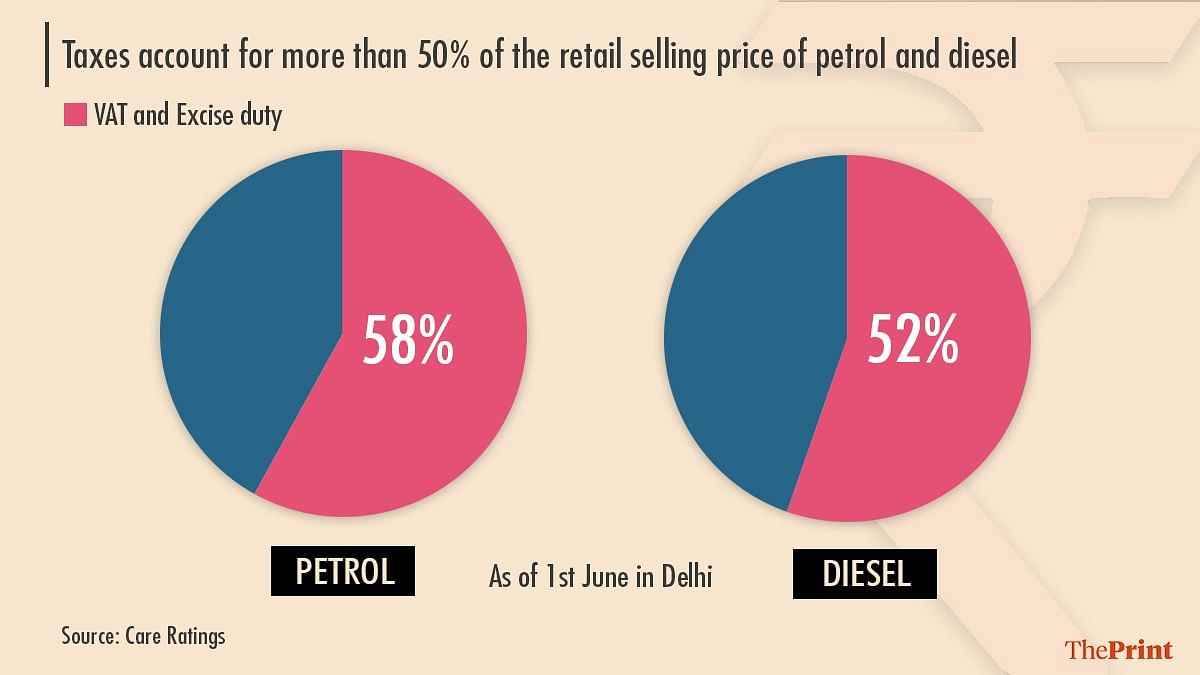

The government of the Union levies excise and excise taxes on fuel, and states levy a value-added tax (VAT). Taxes make up 58 percent of the retail price of gasoline and around 52 percent of the retail price of diesel. This means that if gasoline is priced at 100 rupees per liter, the combined taxes levied by the Modi and state governments would be 58 rupees.

Of that, the Union Government’s excise tax is around Rs 32-33 and the remainder is the VAT that is charged by the states.

Graphics: Ramandeep Kaur / ThePrint

Graphics: Ramandeep Kaur / ThePrint

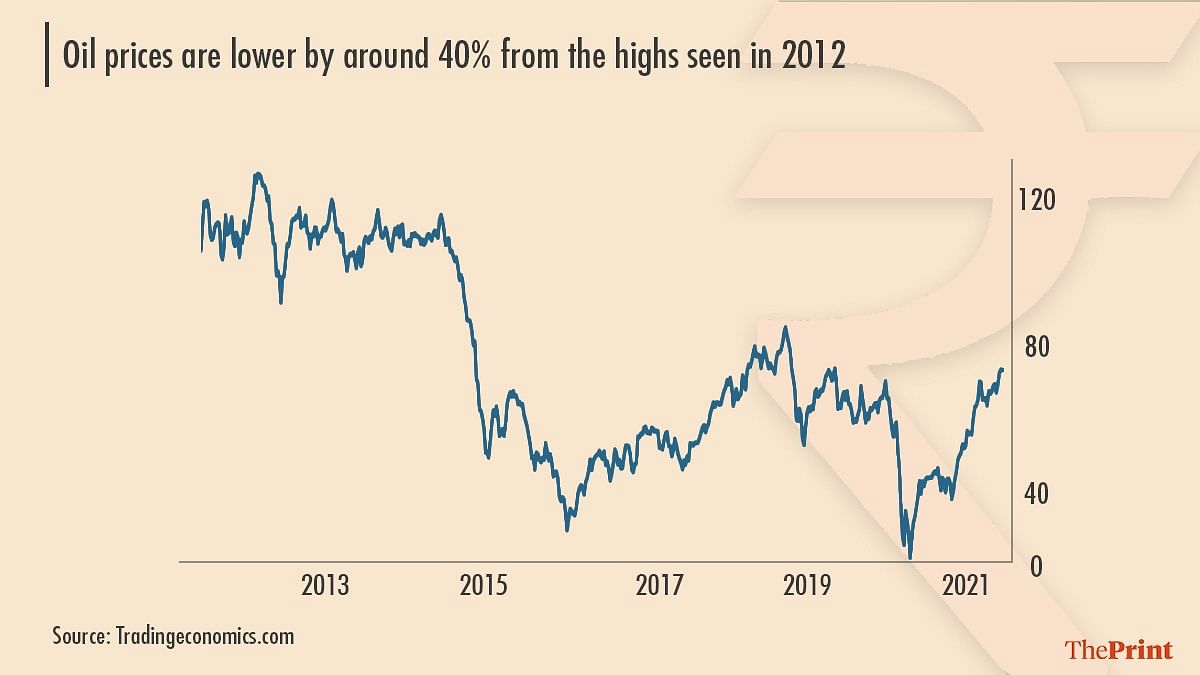

The last increase in fuel prices in India was between 2010-11 and 2013-14, during the tenure of the United Progressive Alliance (UPA) government. But at the time the surge was mainly due to a sharp rise in international crude oil prices, which had hit all-time highs.

The average price of the Indian basket had exceeded $ 100 in those years. However, the retail price of gasoline in Indian cities remained below 90 rupees per liter due to the low prevailing taxes. The excise tax was only 10 rupees on gasoline during this period.

When international crude oil prices began to fall between 2014 and 2015, the Modi government began increasing excise duties from November 2014.

As a result, the benefits of lower international fuel prices could not be passed on to customers.

Graphics: Ramandeep Kaur / ThePrint

Graphics: Ramandeep Kaur / ThePrint

Also read: RBI allows the PMC-Bank to be taken over by Centrum Financial Services to establish a small financial bank

Why Governments Are Reluctant to Lower Taxes on Fuel

Even in the face of rising international prices, the Modi government and the states were reluctant to cut interest rates because these taxes are a major source of income. In the past few months, both sides have exceeded the price of fuel tax cuts and refused to take the first step to cut taxes.

It’s not hard to see why.

The Modi government accumulated Rs 3.89 lakh crore in excise taxes in 2020-21, a 62 percent increase from Rs 2.39 lakh crore accumulated in 2019-20, the majority of which is estimated to be from taxes and excise taxes on gasoline originates.

This increase in tax revenue came despite the fact that oil consumption fell 9 percent in the 2020-21 period due to restrictions on movement due to the Covid-19 pandemic. This is due to the sharp increase in taxes on petroleum products in May 2020.

At that time, the Modi government had raised gasoline prices by 10 rupees and diesel by 13 rupees. This sharp increase came just two months after the government decided to raise excise taxes on gasoline and diesel by 3 rupees.

Typically, the profit to the treasury for every Re 1 of the excise tax increase on gasoline and diesel is around Rs.13,000-14,000 billion. With the Covid-related drop in consumption, however, the increases are likely to be somewhat lower.

It’s the same story for the states. Most states increased sales taxes on gasoline and diesel in 2020-21 to support revenues, while the collapse in economic activity hurt other sources of income.

Value-added tax levied on oil and alcohol makes up 25 to 30 percent of the state’s tax revenue, an important reason why states are resisting the inclusion of petroleum products in taxes on goods and services.

According to the Petroleum Department, the states levied Rs 2 lakh crore – 20 in 2019 and Rs 1.35 lakh crore – 21 in VAT on petroleum products from April to December 2020.

Managed pricing mechanism dismantled, but government controls remain in place

As of June 2017, India abolished the administered price mechanism for oil and diesel. This meant that the oil companies were free to adjust fuel prices daily to reflect international oil price movements. Oil companies can also check these prices daily at events such as elections.

However, in March and April, at the same time as parliamentary elections in four states and one area of the Union, the fuel companies decided not once to raise the rates.

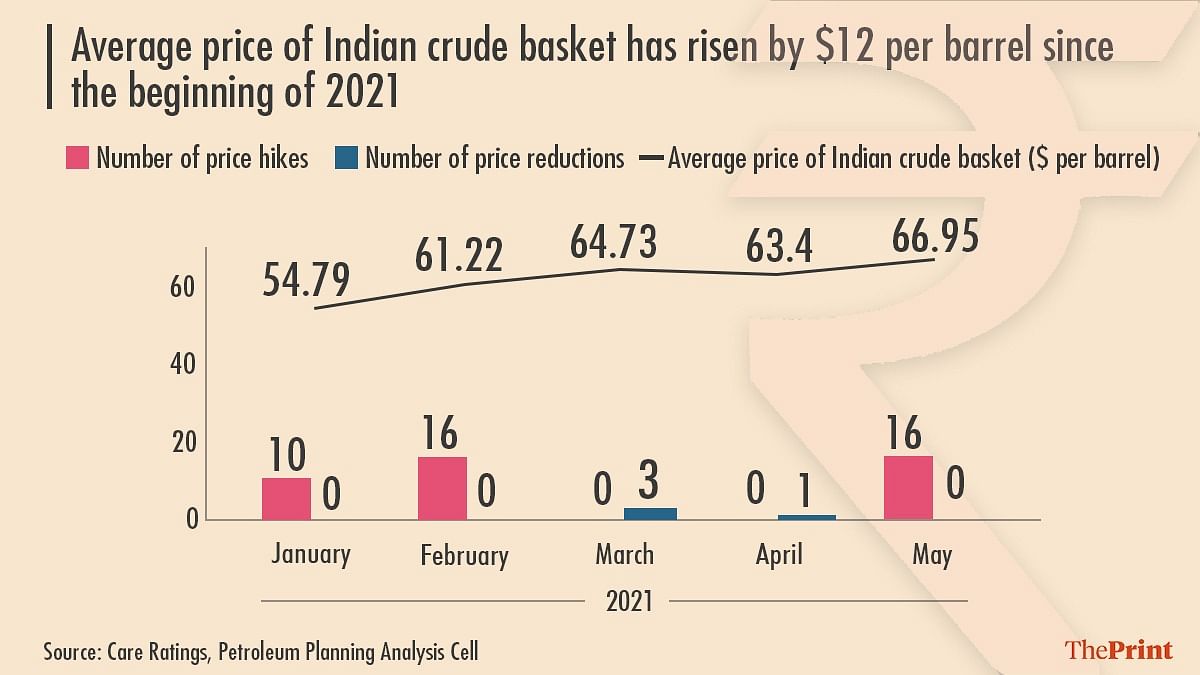

According to data compiled by Care Ratings, fuel companies cut rates three times in March and once in April from 16 price hikes in February. The average price of the Indian crude oil basket was up $ 3.5 in March from February before falling by $ 1.3 in April.

In May, oil companies hiked prices 16 times, although crude oil prices were only $ 3.5 higher than April, reflecting their attempt to make up for two lost months when domestic prices did not accurately reflect international prices.

Graphics: Ramandeep Kaur / ThePrint

Graphics: Ramandeep Kaur / ThePrint

In a market like India, where government oil marketing companies have a market share of over 90 percent, it is not surprising that fuel prices rise during the elections.

Also read: Growth, not inflation, has become the RBI’s priority after the second wave of Covid

Inflationary effects

The rise in fuel prices has put further pressure on inflation in India, which topped 6 percent in May.

Earlier this month, the MPC also highlighted the impact of high fuel prices on total input prices. It had asked the central government and the state governments to lower taxes on petrol and diesel in a coordinated manner.

India’s fuel inflation was 11.6 percent in May, up from 7.9 percent in April and 4.5 percent in March.

There are also concerns that an increase in fuel prices could adversely affect discretionary spending as households cut the latter to reflect higher fuel prices.

(Edited by Amit Upadhyaya)

Also read: Financial instability threatens India’s banking sector: Former RBI Governor Rakesh Mohan

Subscribe to our channels on YouTube & Telegram

Why news media is in crisis and how to fix it

India needs free, fair, hyphenated and questioning journalism all the more as it faces multiple crises.

But the news media is in a crisis of its own. There were brutal layoffs and wage cuts. The best of journalism is shrinking and giving way to a crude spectacle at prime time.

ThePrint is made up of the best young reporters, columnists and editors. To maintain journalism of this quality, you need smart, thinking people like you to pay for it. Whether you live in India or abroad, you can do it here.

Support our journalism