A viral social media post describing the rise in the price of gasoline per liter mentions that state governments levy much more taxes in the form of taxes than the central government. In this article, let’s check that the pricing structure is correct.

You can find the archived version of this article here

Claim: The state government levies more taxes on gasoline than the central government.

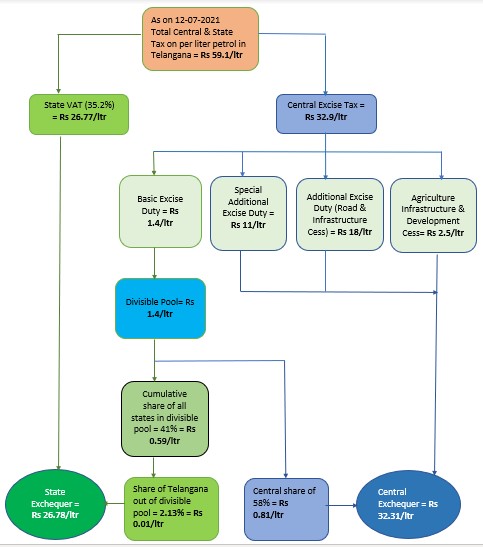

Fact: For every liter of gasoline sold in the country, the central government receives Rs. 32.31 (Zess + central BED part). While the government receives for every liter of sale in the state of Telangana, government Rs. 26.78 (State tax + state share in BED). Which implies that the central government’s tax is higher than that of the state. Hence the claim in the post NOT CORRECT.

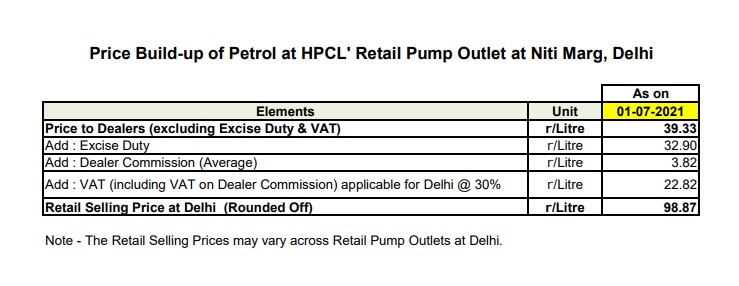

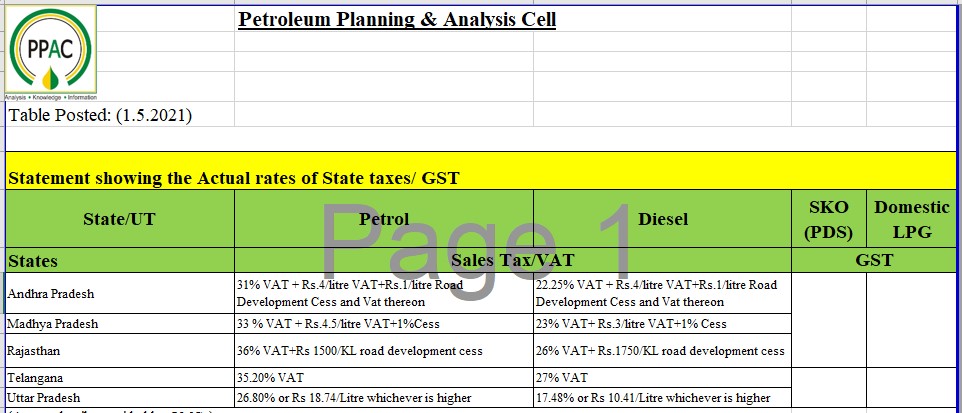

According to the latest information available on PPAC (Petroleum Planning & Analysis Cell) regarding the price structure of liter gasoline in all HPCL gasoline berths in Delhi, the liter gasoline price for dealers on July 1, 2021 was Rs. 39.33 and dealer commission was Rs 3.82 per liter. While the central consumption tax is Rs. 32.90, the state tax which in Delhi is 30% is Rs. 22.82.

Central government tax:

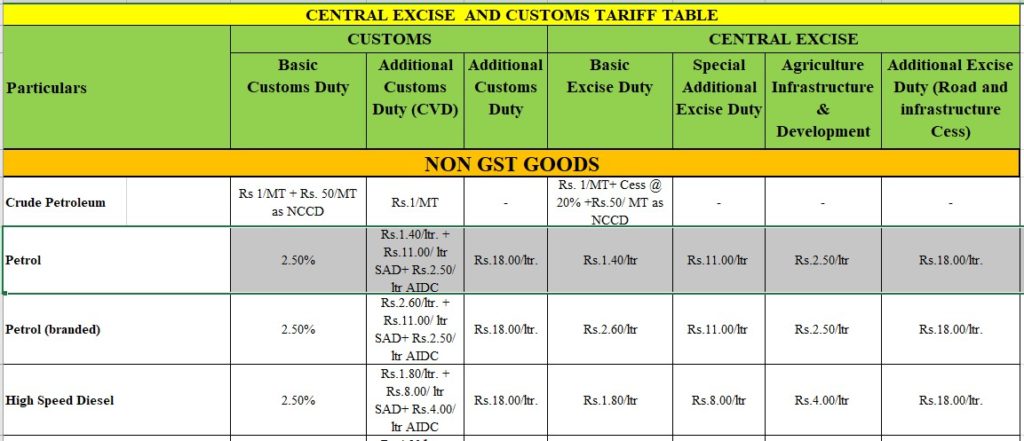

The central government levies excise taxes on gasoline in the form of the basic consumption tax (BED), the special additional consumption tax (SAED), the additional consumption tax (road and infrastructure) (AED) and the newly introduced agricultural and infrastructure development tax (AIDC.). ).

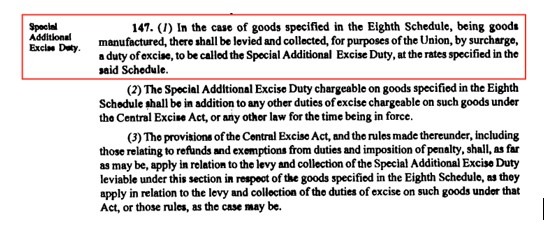

Of these, the Special Additional Excise Duty (SAED) was introduced by the Finance Act 2002. According to the law, however, the consumption tax levied under the SAED is levied in the form of a surcharge and the amount levied is distributed to the center and not to the federal states. In other words, the amount that is collected through this particular additional consumption tax (SAED) is not included in the divisible pool and therefore states would not have a share in it.

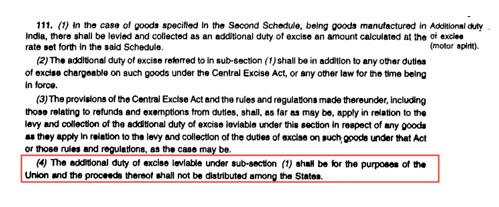

The Additional Excise Tax (AED) on gasoline was introduced by the Finance Act 1998, also known as Road & Infrastructure Cess. The amount collected through additional excise taxes under the Finance Act 1998 also goes entirely to the central government as it is collected for a predetermined purpose in the form of Cess. So states will not have a share in AED. AED for diesel was also introduced by the Finance Act 1999. The states are not involved in this either.

The Agricultural and Infrastructure Development Assignment (AIDC) recently introduced in the budget 2021-22 is collected in the form of a breeding for a predetermined purpose (Agricultural Infrastructure) and thus the states are not entitled to a share in the amount collected in the form of AIDC .

As a result, only the basic consumption tax (BED) is included in the divisible pool that states participate in. The current tax rate on these forms can be seen in the table below.

From the table above we can deduce that the sum of Rs. 31.50 which is in the form of Special Additional Excise Duty (SAED, Additional Excise Duty (Road & Infrastructure) (AED) and Agriculture & Infrastructure Development Cess (AIDC) per Liters of gasoline are charged in full by the central government and the states have no share in it, on the other hand the amount of Rs. 1.40 which is charged in the form of the property tax is the only component that falls under the divisible pool which the states receive a share.

The 15th Finance Commission recommended that states draw 41% from the central government’s divisible tax pool. This means that the states 41% (ie Rs. 0.59) of the Rs. 1.40 base excise tax and the remaining 59% (ie. Rs. 0.81) goes to the central treasury. The sum of the total tax received by the central government per liter of gasoline is Rs. 32.31 (Rs. 31.5 + Rs. 0.81). This is static and the same for every state. ie for every liter of gasoline sold in the country, the central government receives Rs. 32.31 as a central consumption tax.

State tax:

Each state follows its own formula for imposing a state tax on the sale of gasoline and diesel in its respective state. For example, states like Telangana, Karnataka, Odisha, etc. only charge sales tax on gasoline and diesel, while only a few states impose utility charges, fixed fees, and additional fees along with sales tax.

In Telangana, the state government levies 35.20% VAT on liters of petrol. According to the price increase mentioned at the beginning of the article, the Telangana State VAT would be Rs 35.20%. 26.77. In addition, the state government would receive its share from the divisible pool of central taxes. In this case, the state government receives its share from the property consumption tax.

According to the recommendations of the 15th Finance Commission, states would receive 41% from the divisible pool. However, not every federal state receives 41%, but its respective share of the 41%, as recommended by the Finance Commission. The commission recommended 2.13% as the share of Telangana, which means the Telangana government would receive 2.13% of the Rs. 0.59, which is Rs. 0.01 (one paisa) per liter of gasoline as a share of the property tax. This adds up to the total amount of tax that the state government receives per liter of petrol Rs. 26.78 (Rs. 26.77 + Rs. 0.01).

In summary, the central government levies more taxes on gasoline than the state government.