Highlights

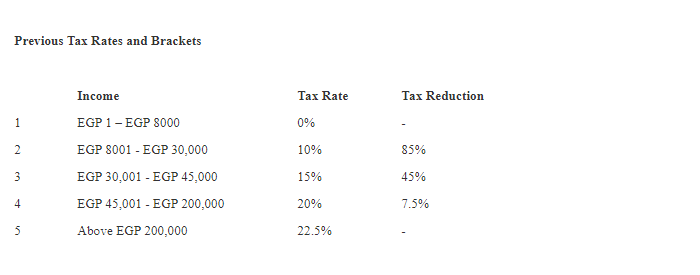

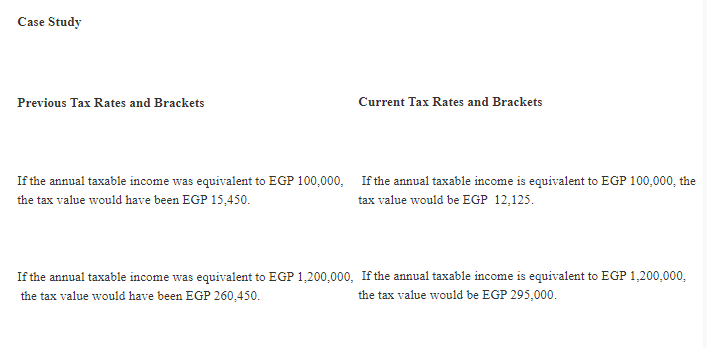

Law No. 26 of 2020 was enacted on May 7, 2020, which amended some provisions of Income Tax Law No. 91 of 2005.modification”), Including the addition of new tax rates and tax brackets and an increase in the annual personal exemption to EGP 9,000.

Scope of change

The change introduces the following new tax rates: 2.5% on the income class between 15,001 and 30,000 EGP and 25% on the annual income above 400,000 EGP. It also ends tax cuts and introduces new tax brackets to reduce the tax burden on low wage earners. In addition, lower tax rates no longer apply to annual incomes over EGP 600,000, which increases the tax burden for higher earners.

The above tax rates and brackets come into effect on July 1, 2020. It should be noted that employers must prepare and submit two tax reconciliation declarations for the 2020 financial year (January 1 to June 30 and July 1 to December 31). .

Facilitation of tax accounting

The amendment re-regulates the application of the additional tax and eases the tax filing process by reducing the tax penalty by 50% to encourage taxpayers to resolve their disputes with the Egyptian tax authorities before referring them to the Appeals Committee. Taxpayers are required to pay an additional amount above the final tax, depending on the difference between the final tax value and the value of the tax stated in the tax return, as follows:

- If the difference is less than 50% of the final tax value, the penalty is set at 20% of the value of this difference.

- If the difference is equal to or greater than 50% of the final tax value, the penalty will be set at 40% of the value of this difference;

- If the taxpayers have not submitted their tax return, the penalty is set at 40% of the final tax; and

- If an agreement is reached with the Egyptian tax authority prior to referral to the appeal committee, the taxpayer is entitled to a 50% reduction in the penalties imposed.