Posted on: Jul 10, 2021 at 10:50 am

Last updated: July 10, 2021, 10:50 am.

Steve Bittenbender

Continue reading

A report released Thursday by the Tax Foundation found that guidelines regarding sports betting taxes in the US vary significantly by state.

The Sportsbook bar stool at the Ameristar Casino Black Hawk in Colorado. The Tax Foundation says Colorado is among the four sports betting states with an effective tax rate that is significantly lower than the actual rate. (Image: Ameristar Black Hawk)

The Sportsbook bar stool at the Ameristar Casino Black Hawk in Colorado. The Tax Foundation says Colorado is among the four sports betting states with an effective tax rate that is significantly lower than the actual rate. (Image: Ameristar Black Hawk)

The study looked at 18 states that currently offer sports betting. Four of these states – Colorado, Michigan, Pennsylvania, and Virginia – found the effective tax rate to be drastically lower than the statutory rate. In some cases the effective rate was less than half the statutory rate.

These four states allowed sports betting providers to deduct advertising costs such as deposit bonuses and free bets to reduce their liability.

Colorado, Pennsylvania, and Virginia also allow operators to deduct federal excise tax. In addition, Virginia even allows loss deductions. Ulrik Boesen, senior policy analyst, wrote that forecasting revenue can be challenging when operators can make such deductions.

In Colorado, voters approved a sports betting referendum in 2019 to fund the state’s water plan. Boesen noted that state officials estimated the state would collect an average of $ 16 million annually from taxes for the first five years. However, from May 2020 to April 2021, the state received only $ 6.6 million.

States that levy a withholding tax should consider a cap if the tax is to generate revenue for assigned expenses, ”Boesen wrote. “Without an upper limit, sports betting providers could theoretically completely eliminate their tax liability, and that does not necessarily have an impact on the proceeds.”

Colorado, which has a rate of 10 percent, has an effective rate of 4.47 percent, according to the study. Michigan, which has a rate of 8.4 percent, has an effective rate of 3.28 percent. Pennsylvania taxes sports betting companies at 36 percent, but the deductions make the effective rate 25.4 percent. Virginia’s 15 percent rate becomes an effective rate of 5.14 percent after deduction.

Lower tax rates can boost betting

According to the American Gaming Association, 21 states and the District of Columbia currently allow sports betting. Two of these states – New Mexico and North Carolina – only allow it in tribal casinos. In addition, 10 other states have legalized sports betting, but sports betting is not yet operational in these locations.

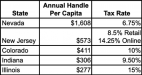

Sources: Tax Foundation and National Conference of the Legislative Bodies of the Länder

Sources: Tax Foundation and National Conference of the Legislative Bodies of the Länder

For those states that have yet to legislate but are considering doing so, Boesen said lawmakers should be careful about how tax policies work in other states.

Nor did he demand that states levy high taxes on sports betting revenues.

“Low-tax countries can generate more economic activity,” he said. “The five states with the highest per capita tax rate all have relatively low tax rates.”

Federal sports betting tax out of date

Boesen added that it is rare to allow a federal excise tax to be deducted for a state’s excise duty. However, he said that states that allow sports betting may be taking the right step.

“The federal tax on sports betting is both outdated and flawed in its design, so that the chance of a successful betting market increases with this deduction,” he said.

The federal excise tax introduced in 1951 levies a 0.25 percent levy on licensed sports betting on every bet. The tax should help fund efforts to deter illegal sports betting. However, its critics point out that illegal bookmarks do not have to pay for anything. That makes their lines more attractive.

The American Association has made tax abolition one of its agenda items for Congress.

Earlier this year, US MPs Dina Titus (D-Nevada) and Guy Reschenthaler (R-Pennsylvania) submitted a bill to repeal the excise tax. It is the second year in a row that the Co-Chairs of the Congressional Gaming Caucus have sponsored the action.