The intention of our NO&T Thailand Special Newsletter is to provide preliminary information and legal analysis for investors in Thailand in relation to investment in Vietnam. Part 1 of our newsletter discussed the legal theory concerning shares/capital contribution subscription and acquisition in relation to each type of company, as well as conditional sectors and caps on foreign investment (see Part 1 here).This Part 2 will provide you with insight on practical issues and with analysis of matters pertaining to M&A in certain specific sectors.

IV. Practical issuesin M&A activities in Vietnam

1. Initial checks and communications

In Vietnam, before entering into a transaction, the investor may request to know certain key legal information, samples as follows:

- Whether the target transaction is subject to any foreign investment restriction of Vietnam laws and relevant international treaties (e.g. capital, business lines, personnel);

- Whether the potential target company structure is legal and realizable in Vietnam;

- Whether there is any specific license the investor/the target company must obtain for/after the dealwhich procedures might be taken for closing the deal, and how long the transaction might last; and

- Whether the target company or its shareholders/managers have committed any serious crimes,been subjected to any administrative penalties, or been involved in any litigation or dissolution.

It is difficult to obtain information about a company and its shareholders/managers from outside sources; except for the initial information about the target company obtainable from a few official sources (e.g. National Portal of Business Registration, National Registrar of Security Transactions Registration, information disclosed by a public company to its shareholders available on its website), which is rather limited. Thus, the investor should seek reliable sources from which to obtain an initial overview about a potential target company and its persons (i.e. sources such as its business partners, knowledgeable persons in its sector, and M&A brokers).After identifying a potential deal, the parties will proceed to initial communications on cooperation opportunities, and minutes of undertaking (MOU) or an in-principle agreement on expected terms will then be executed, or a letter of intent will be delivered.

2. Due diligence (DD)

In Vietnam, investors often request their external consultants to perform three types of information scrutiny: legal DD (“LDD”), tax DD, and finance DD.To the extent of this article, we will only focus on LDD conducted by purchasers and their consultants on the target company.

Normally, LDD begins after (i) the investor has already sent a letter of intent to the seller to express their desire to learn about the Target, or an MOU or a document of similar nature was signed, (ii) a non-disclosure agreement has been executed between the parties, and (iii) the parties have agreed on the time limits for DD. The actual LDD procedure is often as follows:

We observe that an LDD to a local target company often concentrate on the information about its corporation and establishment, assets, labor, loans and liabilities, material contracts, IT&IP, and litigation. In addition to legal expertise, as LDD is rather a new concept for most of local companies, conducting an LDD in Vietnam also requires communication skills also. The managers often try to give a “perfect image” of the company and hide all negative issues. They are also reluctant to provide important or sensitive information. Moreover, if the target company is a state owned enterprise, its disclosure of information may be subject to the prior approval of its managing state body. Running dual accounting books, payroll systems, transactions with related parties, price transferring are some of the big issues that may make LDD become time and effort consuming. Thus, the purchaser should engage an experienced LDD consultant.

3. Contracts negotiation and execution

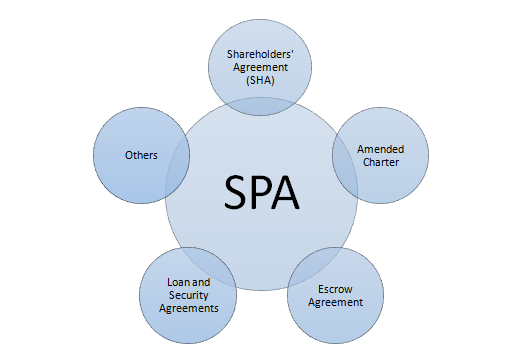

- Contents of the negotiation often revolve around three themes: the transaction price, rights and obligations of the parties in and after the transaction, and procedures of the transaction. They are shown in texts of the following definitive contracts, with the key role of a shares purchase agreement/ shares subscription agreement/ equity transfer agreement (collectively, “SPA”).

- SPA sets out key terms and conditions for deals, with groups of (i) commercial terms (transaction price, procedures), (ii) conditions precedent, representations and warranties (R&W), covenants (pre-closing and post-closing), and (iii) boilerplate clauses (communications, dispute resolution forum, applicable law, language etc.). In practice, most of the local companies and their shareholders/members are not familiar with the contents of a typical international standard SPA. It would take time for the purchasers and their lawyers to explain and persuade the sellers. In certain cases, the sellers did not thoroughly understand the content of the SPA content and even requested to change some of its content at the last minute.

- SHA is an agreement to set up the relationship between the parties in the Target after closing a deal, so it often takes actual effect from the closing date. The parties should consult with legal consultants carefully in advance on SHA contents, because such rights and obligations may lead to merger filing, or be inconsistent with Vietnam law on enterprises. Notably, although SHA is now commonly used in M&A transactions, it has not yet been recognized and expressly stipulated in the LOE, LOI, or any other relevant regulations. In theory, in light of the principle of free negotiation under the Civil Code, the SHA will be valid and bind the parties. However, in the case of discrepancies between the SHA contents and the charter contents, it is unclear whether or not the SHA will prevail even when this is set forth in the SHA.

- The amended charter or new charter shall take effect after the investor officially becomes a shareholder of the target. It reflects parts of SHA and corporate governance terms under the laws. Pursuant to the LOE, charter must contain compulsory clauses.

- An escrow agreement is necessary if the parties agreed that the purchaser shall escrow an amount (a part of transaction price) at banks. As a bank often has its own template of an Escrow Agreement, parties may discuss with the bank to use their own form, or to review such template.

- A loan agreement and a security agreement are necessary for a deal in which the investor agrees to lend money to the target company. Parties should take into account that the loan agreement may need to comply with registration requirements of State Bank of Vietnam (“SBV”) for medium-term and long-term foreign loans, and security arrangements may be required to be registered at National Registration Agency for secured transactions for security perfection.

- Other definitive agreements would be discussed between the parties.

In our experience, the parties should set a clear timeline for the negotiation and the transaction. Regarding contract execution, foreign investors should cautiously check the authority of the signatory of an enterprise because, in light of the laws of Vietnam, only the legal representative of an enterprise (or a person duly authorized by him/her) has the authority to sign a contract on behalf of such enterprise.

4. Closing and post-closing

Based on the size and complication of each deal, the parties may tailor their closing procedure. Generally speaking, parties only proceed to closing when conditions precedent to closing and pre-closing covenants have been satisfied, and R&W are true, accurate, and complete on the closing date. The purchaser may, at their own discretion, decide to waive or temporarily waive conditions, covenants or accept untrue, inaccurate or incomplete R&W to facilitate the closing process. On or immediately before the closing date, licensing procedures, payment of contract price, and record of the investor’s information to shareholders’ registry will be required. Post-closing obligations may last for years, and concurrently occur with the operation of the target company. For securing post-closing obligations, the purchaser may propose to withhold a part of the transaction price during a reasonable time after closing.

Notably, for closing the deals, the sellers must declare and pay their capital transfer tax in accordance with Vietnam regulations. If the sellers are individuals, they may pay their personal income tax by themselves, or the target company may pay the tax on behalf of them. Tax rates applicable to individual sellers depending on the nature of the target company, which may be either 20% of the profit (in the case of an LLC) or 0.1% of the transfer price (in the case of a JSC)[1].Tax rates for corporate sellers will comply with Corporate Income Tax Law.

5. Exchange Control Regulation on Direct Investment into Vietnam

In order to monitor capital outflows and stabilize the value of the Baht currency, the Ministry of Finance (the “MOF”) has empowered the Bank of Thailand (the “BOT”) to be responsible for administering foreign exchange,[2] and foreign exchange transactions shall be governed by the following laws: i) Exchange Control Act of 1942; ii) Ministerial Regulation No. 13 of 1954; and iii) the relevant Notifications of the MOF and Notifications of the Exchange Control Officer.

The following stipulationsembody the relaxation of exchange control regulations with respect to fund transfers by Thai investors for Thai overseas investment:[3]

- Capital transfers by Thai juristic persons shall be allowed with no limitation on amount in relation to i) investment in an overseas business entity, no less than 10% of the shares in which are held by such Thai juristic persons, or ii) investment in or lending to affiliated business entities overseas;

- Capital transfers by Thai juristic persons for lending to non-affiliated business entities overseas shall be allowed in an amount up to USD 50 million per annum; and

- Capital transfer by a Thai natural person shall be allowed without any limitation on amount for: i) investment in an overseas business entity, no less than 10% of the shares of which are held by such person; or ii) investment in or lending to affiliated business entities overseas.

Generally, the fund transfers for such investment or lending to business entities overseas shall be executed in foreign currencies only; however, in the case of investment or lending to business entities in Vietnam or countries neighboring Thailand, the fund transfers are permitted to be executed in Thai currency as well.

6. Liaison Services from the Board of Investment

The Office of the Board of Investment (the “BOI”) of Thailand is a government agency under the authority of the Office of the Prime Minister. The main roles and responsibilities of the BOI are to promote not only investment in Thailand but also Thai overseas investment, in order to enhance the competitiveness of Thai businesses. With respect to Thai overseas investment, the BOI, through the investment promotion officer to be posted overseas at each Thai embassy, including in Hanoi City, provides counselling services on overseas investment and liaises between Thai investors and the relevant local government agencies of the target country.

V. M&A insome special sectors

1. Distribution

M&A in the retail sector plays a leading role of the M&A trend in Vietnam with big transactions, for example, Central Group acquired BigC and Nguyen Kim, TCC Holdings acquired Metro Cash & Carry Vietnam. M&A is considered a fast and effective way for foreign retailers to enter the Vietnam market. According to Decree 09/2018/ND-CP on trading goods by foreign investors and foreign invested enterprises in Vietnam (“Decree 09”), an FIE must obtain a trading license to carry out retail services and retail license is required for it to open each retail store from the second one. Although Vietnam has committed to open its retail market (save for special products like sugar, oil, rice, pharmaceutical products), there remain technical barriers challenging foreign investment. In practice, it takes time and effort to open an additional retail store. By acquiring a local company that has already set up and run a chain of retail stores, foreign retailers may quickly enter into the retail market without waiting for long procedures to obtain required licenses as well as to seek locations, local suppliers and customers. Meanwhile, local retailers may also take advantages of foreign investors in term of management skills, capital, and supplies.

2. Banking

The highlight of M&A transactions in the period from the second half of 2019 to now was in the banking sector. The biggest transaction being recorded in banking sector during such period was the deal in which SMBCCF (a subsidiary of SMBC) acquired 15% of the shares of FE Credit (a subsidiary of VP Bank) at a price of USD 1.4 billion[1]. In fact, Vietnamese banks, especially small ones, are targeting more foreign capital to improve their performance and financial expertise. Besides, SBV is seeking opportunities to sell three banks that SBV has purchased at the price of VND 0[2] (i.e. Ocean Bank, GP Bank, and CB Bank) to foreign investors. Thus, it is expected that M&A in the banking sector will increase in the future although it is one of the most complicated types of M&A. M&A in the banking sector is circumscribed by the restrictions and conditions stipulated by the Law on Credit Institutions and the related implementing regulations, in particular:

- Foreign ownership in a credit institution is limited to a relatively low ratio under Decree 01/2014/ND-CP: a single foreign investor shall not own more than 15% of charter capital of a credit institution, save that a strategic foreign investor may own up to 20% of charter capital; the cap for foreign ownership in a commercial bank is 30% of charter capital; under EVFTA, in the near future, a European investor may increase its ownership ratio to a maximum of 49% (in aggregate) in two Vietnamese joint-stock commercial banks, except for the top-four state-controlled banks (i.e. Vietcombank, BIDV, Agribank, Vietinbank);

- A foreign investor shall satisfy the criteria on creditworthiness ranking, finance, assets and stability in order to invest in a bank; and

-

In addition to procedures applicable to common deals, banking M&A activities must comply with banking regulations, including but not limited to obtaining approval from SBV.

3. Energy

In order to satisfy the increasing demand for electric energy, the government has introduced various policies to attract foreign investment. Resolution 55/NQ-TW on the direction of Vietnam’s National Energy Development Strategy to 2030, vision to 2045 and the related implementing regulations promote investment in, and have attracted foreign investors to invest in, the sector of renewable energy. The feed-in-tariff (FIT) of 7.69 US cents/kWh proposed by the Vietnam Government for solar power under Decision 13/2020/QD-TTg of the Prime Minister still seems a good offer for foreign investors.[1] As it is much easier to acquire an on-going energy project through the acquisition of the project company than to start a new project requiring the satisfaction of multiple procedures and conditions, a series of M&A deals in the energy sector, especially the acquisition of renewable power projects by Thai investors, have taken place. For example, Gulf Energy Development and Sermsang International invested in several solar and wind power projects of Truong Thanh Corporation, and Banpu invested in a wind power project of EAB New Energy GmbH.[2] In comparison with other sectors, the energy sector has experienced fast changes in terms of governmental policies and incentives. That may put the foreign investors in precarious situations and force them to speed up their M&A transactions and investment.

4. Real estate

Real estate is a special sector with numerous strict regulations in terms of land use rights, construction, and real estate business that would be difficult for a foreign investor to understand and digest. In practice, it may take several years, even a decade, and a huge amount of investment capital, for a foreign investor to set up a new real estate project in Vietnam. Land lots in good locations of big cities, industrial zones, beaches, etc., have been acquired by local investors that have deep knowledge about the market and a closed relationship with the state authorities. Thus, M&A would be the best way for a foreign investor to penetrate the real estate market. Numerous M&A transactions were concluded in 2020 (e.g. SK Group acquired shares of Vingroup, and Keppel Land acquired the owner of Saigon Sports City project). USD billions has been injected into the real estate market. It is reported that, even amid the pandemic and the gloomy macro-economy, the total of foreign investment capital injected into the real estate market in 2020 was around USD 2.35 billion.[3] Below are issues that a real estate investor should take into account:

- Under the Law on Real Estate Business, a FIE is only allowed to provide certain services (e.g. not permitted to purchase buildings for sale, lease, sub-lease). Therefore, the purposes of the investor may affect the deal potency;

- Not all real estate projects are transferable. Projects to be transferred must satisfy conditions under the laws of Vietnam, such as finishing compensation and ground clearance works; and

- The licensing procedure for real estate M&A often lasts unreasonably long, because, beside ordinary M&A procedures, transferred real estate projects must go through several appraisal and approval processes with the land authority.

5. Healthcare

Healthcare M&A is reportedly emerging because of the Covid-19 pandemic and people’s heightening attention to a healthy lifestyle. Although state owned hospitals and pharmaceutical companies still dominate the healthcare market, deals have been made to acquire shares in private hospitals, pharmaceutical companies, and health-tech or cosmetics companies. Foreign investors have acquired shares via private placement or share exchange in some pharmaceutical companies (e.g. Stada Service Holding B.V. and its related persons acquired shares from the local shareholders in order to wholly own Pymepharco JSC, and Taisho Pharmaceutical Co., Ltd. (Japan) has increased its ownership in Hau Giang Pharmaceutical JSC to 51%). In fact, regulatory issues are a key concern for M&A in this sector, as healthcare businesses are strictly managed by the Ministry of Health by way of multiple licenses.