A group of tech giants led by Amazon founder Jeff Bezos and the CEO of Lyft are pushing for something companies almost never ask for: higher taxes.

The Chamber of Progress – a group of Silicon Valley companies formed in March to counter some of the anti-tech undercurrents on Capitol Hill by promoting Democrats – is advocating a higher corporate tax rate, President Joe Biden recently said proposed to increase to 28% from 21%.

This is not expected from corporate groups. The chamber, whose “corporate partners” are Amazon, Google, Uber, Lyft, Facebook, Twitter and a handful of startups, describes itself as “not just another group of companies”.

It’s generally an easy stance for them, say corporate tax experts, finding that these companies are often not paying anything near the statutory tax rate right now. This is due, among other things, to the significant losses most tech startups suffer in their early years, the ease with which the sector can move intangible assets such as patents abroad, and adequate research and development credit that makes those effective Lower corporate interest rates.

While these companies are publicly backing a corporate rate hike, they will likely fight other corporate tax proposals in the backend in the White House, tax experts say. These proposals include a tax on reported income, a minimum tax on global income, and changes to the international regime of the 2017 Tax Act to get rid of the carrots and sharpen the whips.

“In the end, companies may have thought that this was the path of least resistance: we will accept the tax hike that makes us look good for public consumption, but then we will fight like hell to narrow or reduce the tax base,” said Robert Willens, a New York based tax advisor.

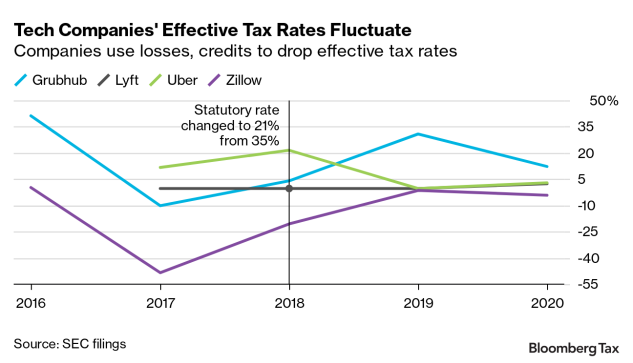

The effective tax rate is the actual tax rate at which a company will be taxed after a number of adjustments to its balance sheet, such as: B. Dollar-to-dollar tax rebates from research and tax credits paid in overseas jurisdictions or income deductions to make it no longer taxable. The effective rate may differ from the statutory corporate rate of 21%, which the 2017 law lowered from 35%.

“I think if you ask the average Silicon Valley leader if they’re willing to have their company pay a little more in taxes to support investments in clean energy, broadband, professional training, and manufacturing, most of them would say they do one is a fair deal – and good for the country, ”said Adam Kovacevich, the group’s founder and CEO who has worked for Google, Lime and former Senator Joe Lieberman (I-Conn.).

Kovacevich’s comments, first published in a Medium post in April, come from large corporations choosing their corporate tax struggles from a range of punitive proposals from Democrats.

From members of the group, spokesmen for Instacart, Lime and Twitter declined to comment. Lyft, Uber, Amazon, Automattic, DoorDash, and GrubHub, also members, didn’t respond to multiple requests for comment.

Facebook and Getaround spokesmen said in separate statements that the companies are affiliated with outside groups like the Chamber, but do not necessarily endorse their positions on public policy issues.

José Castañeda, a spokesman for Google, said in a statement emailed that the White House tax proposals “deserve further discussion” and that the search giant “wants an ongoing focus on global competitiveness for the US” and “the US.” – Leadership for a New International Tax Agreement Advocates “That supports much-needed investment for America’s economic future. “He declined to comment further.

Offset taxes

Bank of America analysts estimated that Biden’s full tax plan would result in after-tax profits of a handful of internet companies, including Amazon, Facebook, Google, and Twitter, falling by around 7% on average. Key contributors to these four factors included the elimination of amortization on foreign intangible income and tax on financial reporting income, analysts said in a report in late April.

When companies have large amounts of unutilized tax benefits that they carry forward from year to year – what are known as “deferred tax assets,” which are often composed of losses and credits – an increase in the corporate tax rate makes those assets more valuable. For example, a $ 100 million loss deduction equates to $ 21 million in reduced taxes below the current corporate rate and $ 28 million in reduced taxes below the White House proposed rate.

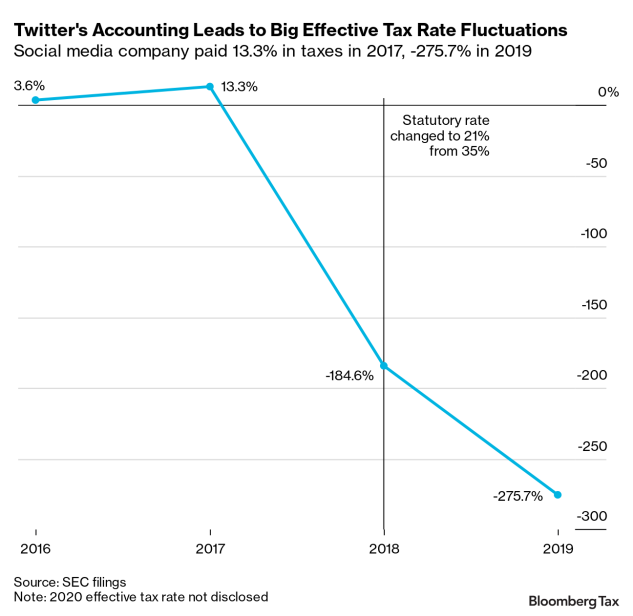

In its most recent annual filing, Uber reported losses of $ 13.6 billion, while Lyft reported $ 6.2 billion. Zillow, another member of the chamber, reported $ 1.7 billion in late 2020. Twitter reported federal losses of $ 2.19 billion. Google’s parent company, Alphabet, announced $ 3.1 billion.

Even when startups become profitable, they tend to have huge historical losses that they postpone year after year to offset their taxes. Some companies – including Alphabet, Zillow, Lyft, Uber, and Twitter – impose something called “allowance”, which is essentially the jargon for storing tax breaks that a company doesn’t think are profitable enough to ever take advantage of.

When companies make changes to their allowances and add or release some of the tax benefits they put away because they don’t believe they are making enough profits to take advantage of them, it can cause huge swings in their effective tax rates to be the case for Twitter.

“The legal rate doesn’t really matter to unprofitable businesses,” said Patrick Badolato, a senior lecturer in the University of Texas accounting department at the Austin McCombs School of Business.

Companies with large deferred tax assets, Badolato said, “don’t have to pay taxes until they have enough profits to offset their historical losses,” and “it could take several years and even various legislatures for many of these companies to pay a significant amount in taxes. “

Companies like Facebook and Google have flexibility in where their intellectual property is located and how tax credits are used, which can lower their effective tax rates, Badolato said. Amazon, riddled with research and development credits and deductions for stock-based compensation, has low profit margins and invests again and again in R&D and enhancements every year, driving its tax rate into lows that have made the e-commerce giant more progressive Anger.

A higher corporate tax rate could even help Amazon by hitting its brick and mortar retail competitors, who tend to pay closer to the statutory corporate tax rate, said Andrew Silverman, a tax policy analyst with Bloomberg Intelligence.

“A higher corporate tax rate makes it very difficult for a medium-sized retailer to stay in business,” he said.

Lobbying efforts

Facebook, Uber and Google have reported lobbying on international tax issues since the tax law was drafted in 2017, as disclosed by disclosure forms indicating that they have an interest in influencing Democrats who plan to tighten this international regime as part of an infrastructure plan.

It would be surprising if Amazon, Uber and Facebook, and to a lesser extent Twitter and Lyft, didn’t reach out to the House’s tax policy committee over the next few months to discuss how the White House proposals affect them, said a domestic worker on condition of anonymity.

Companies don’t want to score as unreasonable by immediately rejecting proposals, the employee continued – they want to offer a solution based on their financial profile.

When tax legislation is “in progress,” companies are always around the corner and want to be heard, said Todd Simmens, former legal advisor to the Joint Tax Committee who is now a national managing partner at auditing firm BDO.

“I can imagine these companies going through some kind of calculus,” said John Gallemore, associate professor of accounting at the University of Chicago’s Booth School of Business, who specializes in corporate taxation.

Gallemore added that he viewed the group of companies as a “pandering” for politicians.

“If they just come out and say they are behind a higher rate, maybe they can negotiate or lobby behind the scenes or roll back some of those changes that they might be less enthusiastic or enthusiastic about,” he said.