BOSTON — Within a short time of receiving several hundred thousand dollars from investors for his start-up app company SnoOwl, Jasiel Correia II spent more than half the money on travel, entertainment, luxury items and paying off personal debt.

Correia then attempted to hide those personal expenditures as business expenditures on his tax returns. He also hid from the IRS the fact that SnoOwl, a partnership, even existed, according to testimony Friday.

That was the gist of the government’s case on Friday against the former Fall River mayor, with the majority of the day’s testimony from IRS criminal investigator Sandi Lemanski, of the agency’s public corruption unit. Lemanski testified that over the course of three years, investors gave Correia a total of $358,190, but he wasted little time spending the money on personal use.

The IRS agent said during direct questioning from Assistant U.S. Attorney Zachary Hafer that, by her calculations, in 2013 investors handed over $132,800 to SnoOwl, with Correia spending $105,032 on personal items — or 79 percent — rather than on development of phone app technology.

In 2014, investments totaled $112,890, with Correia using $55,916 for himself — or 40 percent. That was his first year as a city councilor.

And in 2015, SnoOwl investors ponied up $112,500, with Correia keeping $67,706 — or 60 percent — of the investment to himself. This occurred during Corriea’s second year as a freshman councilor and his first as mayor, after he defeated former Bristol County District Attorney Sam Sutter.

Earlier this week, four SnoOwl investors testified against Correia, saying they initially believed Correia was an impressive young entrepreneur who had early business success while in college. It was a pitch that SnoOwl business associates also testifed that they believed.

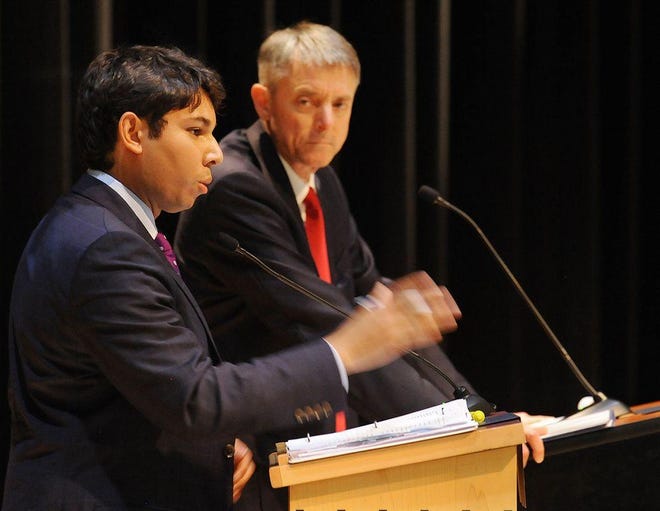

Hafer played a brief video clip of a 2015 debate between Correia and Sutter, who challenged Correia’s claims of SnoOwl’s succes, saying, “Show us the beef, show us the money, it doesn’t look like SnoOwl is doing anything.”

Correia responded that Sutter was “showing his inexperience in the business community” and that his investors were “his partners.”

“We’ve gotten hundreds of thousands of dollars from our investors and our goal is to get them a return on their investment. That’s exactly what I do,” Correia said in the debate.

But Reddington countered in cross examination of Lemanski that Correia’s “business acumen was lacking” and in the early stages of SnoOwl that his record keeping was “incomplete and sloppy.”

He asked Lemanski if she agreed.

“They were incomplete, I don’t know if they were sloppy because there’s no record to be sloppy,” said the agent.

The first week of testimony in the federal corruption trial of former Fall River Mayor Jasiel Correia II wrapped up Friday at John Joseph Moakley United States Courthouse.

U.S. District Court Judge Douglas P. Woodlock is presiding over the trial in Courtroom 1.

Correia faces 24 counts, including tax fraud in relation to his app company, SnoOwl, and extortion and bribery in relation to an alleged pay-to-play scheme he set up with marijuana vendors looking to do business in Fall River.

More:Who’s on the list? Potential witnesses in Jasiel Correia II corruption trial disclosed

Assistant U.S. Attorneys Zachary Hafer and David Tobin have questioned 20 witnesses, ranging from SnoOwl investors, to former business associates, and even an ex-girlfriend. Today, jurors heard from the woman who prepared Correia’s tax returns and the IRS special agent in charge of the investigation into his financial records.

Prominent Brockton defense attorney Kevin Reddington is representing Correia.

Friday’s session was only a half-day.

Tax preparer from Fall River questioned

Stacia Vieira, a tax preparer who worked at Libterty Tax on South Main Street in Fall River took the stand, and described some of the procedures for filing a tax return. She is the one who prepared a tax return for Correia.

Tobin established how a tax prepration service prepares tax returns for people, how they’re signed electronically, etc. Note: They discussed how tax returns are signed electronically — wire fraud charges pertain specifically to the use of electronic communications.

Correia’s form stated “free dependent,” and Vieira explained that he was a dependent of his father, also named Jasiel Correia. “Even if he was a City Councilor,” Tobin asked, with a chuckle.

Vieira’s employee, Joyce Carreira, entered the data on the tax return. Information, Vieira stated previously, is provided by the client.

Vieira confirmed a 2013 information verification form for Correia listing his income as $6,630. Providence College was paying Correia this amount.

Vieira testified that she finished the tax return, and confirmed that she was present when Correia initialed the form. She said typically they would go through each entry on the form and ask questions like, “Did you have any other sources of income?”

No mention of SnoOwl or SnoKimo, Vieira confirmed. On his initial 2013 return, he marked as business income $0. Same for rents, royalties and partnerships. Same for “other income.”

The form for the 2013 tax return is signed by Correia on Feb. 18, 2015.

Tobin showed Vieira a 8879 federal form that she said serves as the signature when return is filed electronically. The signature on the form dated Feb. 18, 2015, is Jasiel Correia, and this was in the second year of his two-year term as City Councilor.

Tobin was establishing how Correia’s initial 2013 tax return was e-filed. Once again, wire fraud charges involve the use of electronic communications — that’s why the prosecution is establishing specifically that it was e-filed.

Looking at Correia’s 2013 form 1040, line 12 — where business income would be (calculated on a Schedule C) — the number was $0, because he did not fill out a Schedule C.

Liberty Tax client data sheet for 2014 says he was not self-employed. The form was signed on Feb. 18, 2015. His W2 from the city of Fall River listed an income of $16,091. He reported no business income in the tax year for 2014; same for rents, royalties, partnerships. Again, Vieira testified that Correia signed this form asserting that the information in the return was accurate.

Also, Vieira confirmed the electronic signature form.

Vieira said he never mentioned SnoOwl, SnoKimo or any type of partnership, confirming he would have been asked about any other income or partnerships.

Reddington’s cross-examination of the tax preparer

Reddington begins by confirming with Vieira that Liberty Tax uses a catchy jingle in its commercials and often has folks dressed as the Statue of Liberty to draw in customers from the street.

He even mentioned the “Liberty, Liberty, Liberty” part of the jingle — but that jingle is for Liberty Mutual insurance, not Liberty Tax Service.

And he established that Vieira did tax preparation for Correia’s father.

But that was it for his questioning.

IRS special agent Sandra Lemanski takes the stand

Sandra Lemanski is a special agent with the criminal division of the Internal Revenue Service. She has a specialty with financial investigations for organized crime. In fact, she was an investigator in the case of mob boss James “Whitey” Bulger. Reddington represented Bulger’s girlfriend, Catherine Grieg.

In 2017, a grand jury subpoenaed records of SnoOwl. Jasiel Correia was the custodian of records — that is, the one responsible for due diligence, said Lemanski.

Lemanski shuffled through a binder of documents that looks about six inches thick.

Citizens Bank records for a SnoOwl account and a SnoKimo account were produced through a grand jury subpoena.

Lemanski said the Citizens Bank account was opened as a partnership. Chris Parayno, Chris Mello and Jasiel Correia were the three listed.

A sole proprietorship is an unincorporated business owned by one person, and income is reported on a Schedule C. A partnership is an unincorporated business owned by more than one person, and income there is reported on a different form, Form 1065.

She said that during 2013 and 2014, SnoOwl would have been considered a “partnership.” “Mr. Correia made no personal financial contributions to the partnership” and so therefore investments in the company would have been considered capital gains, she said.

Looking at tax documents for Common Solutions — the legal name for Find It Networks— partners listed were Correia and Alec Mendes.

Lemanski said she is also familiar with SnoKimo, a website development company that Correia co-owned as well, at least according to his LinkedIn profile. Lemanski said there were income-based deposits into the account. For 2013 and 2014 there were deposits of income from Arias Jewelers, Aesthetic Laser Exchange and Community Foundation ($2,137.50).

On Wednesday, Arias Jewelers owner Sergio Arias testified that he paid Correia to create a website, but it was never done.

Lemanski testified that money used to pay for travel to the Intercontinental Hotel and other luxury expenditures came from accounts that were SnoOwl accounts, and that these expenditures were classified as business-related expenses.

Is the mischaracterization of these expenditures something that the IRS considers material?” Hafer asked and Lemanski said yes.

For tax purposes the bag $258.85 Kate Spade handbag — which ex-girlfriend Natalie Cleveland already testified she received as a gift from Correia — was declared as a business deduction on Correia’s 2014 amended tax return. She testified that Jasiel Correia campaign signage was paid for with SnoOwl funds from the Citizens Bank account.

Sallie Mae, student loan records were subpoenaed by the grand jury — also paid through SnoOwl accounts.

As well, the grand jury subpoenaed records for Autobahn USA, which show a purchase of a 2011 Mercedes by Jasiel and Maria Correia. Several receipts for places like Lululemon, a helicopter ride and a personal trainer show Correia used cash and credit card to pay for purchases.

Lemanski testified that the total amount of investor funds that Correia received for SnoOwl — for which there were records — was $358,190. Expenses reclassified as personal were done only with witness statements or receipts, otherwise Lemanski left it as a business expense.

Pie charts summarized personal purchases made by Correia using his SnoOwl account. These included clothing, health care products, jewelry, personal grooming, personal trainers, donations, campaign expenses, etc.

- Hotel expenses: $27,023.10

- Restaurant expenses: $25,121.18

- Transportation expenses : $31,780.02

- Personal loans and credit card payments: $37,282.02

- Entertainment expense: $4,581.89

A lot of this was adult entertainment, casinos and tens of thousands in cash withdrawals.

Hafter noted that there were 66 pages of information to go through, from 2013 to 2015. The binder Lemanski is looking through is huge. So far, Hafer and Lemanski have referred to the “voluminous” records that she pored over.

In 2013, investigators estimated he spent 79% of the investor funds on personal use. In 2014, they say he cut back a bit — only 50% of investor funds were used. In 2015, he used 60%. All told, 64% of investor money was used for himself, she said.

Lemanski said the total of personal expenditures from the SnoOwl account from 2013 to 2015 were $228,654.

Lemanski said there are no SnoKimo records on file with the Secretary of State.

After depositing a check deposited from investor Steven Miller Aug. 22, 2013, Correia paid $7,000 on a personal loan at Fall River Municipal Credit Union and $2,400 on personal credit card balance. He also gave $4,000 to Flint Merchants Association that Carlos Cesar testified about Wednesday.

On Nov. 18, 2014, after a check was deposited from another investor — Mark Eisenberg — Correia spent money on air travel and meals.

January 2014 deposits of checks from Miller and Hildegar Camara were followed by a purchase of tires for Correia’s personal vehicle, said Lemanski; as well there was a cash withdrawal at Twin Rivers casino, and $300 cologne purchase from Neiman Marcus.

After a call from Sallie Mae, a student loan service, in which Correia said he didn’t have money to pay his student loan, records show he stayed at the Chatham Inn on July 14, 2014.

Lemanski said there was income from Nordstrom in 2013 for approximately $6,000 that was not recorded on his tax returns.

In a video from a mayoral debate in 2015, Correia said he spent his SnoOwl investor money wisely. “An investor is part of your business. It’s not a loan. … It’s not a loan, it’s not a debt,” said Correia at the debate. At the time he said investors were his partners and he would also spend residents money wisely if he was elected mayor. The SnoOwl account had a minimal balance at the time, Lemanski said.

Reddington questions Lemanski

Reddington began by asking about procedure — how the IRS’s investigation proceeded, who did what, did she have assistance, and so forth.

He then asked Lemanski about business expenses, and if the purchase or lease of a car is a common business expense. The vehicle has to be considered a business asset and depreciated, she said. “It has to be purchased in the name of the company,” she said.

Sticking to his depiction of Correia as being young — just out of school, still living with his parents — Reddington said she made a big assumption that Correia would have documented his business/personal expenses properly. “That’s what’s required,” Lemanski said. She did not agree that he had no business acumen.

Reddington asked if she knew that Christopher Parayno had access to the Citizens Bank account. She did not know that, but said she knows he testified later that he did not.

If it was a business expense classified as sole proprietor, he could not take the deduction, she said.

If Correia was at a SnoOwl event — restaurant or strip club — is that a write-off, Reddington asked.

Reddington asked Lemanski if she’s aware of the connection between lawyer Nick Bernier, Chris Carreiro and Terry Charest, the CPA he said they referred Correia to.

He asked her if she knew Stafford Sheehan signed a MOU indicating he was contemplating taking over as CEO, and if knew Bernier sent out blast email welcoming his as CEO. She confirmed she did.

Reddington continued to throw out lots of names — Nick Bernier, Stafford Sheehan, Christopher Carreiro, Terry Charest — and law firm names, like Goodwin Proctor. Rather than dispute Lemanski’s findings that Correia depicted personal purchases as business expenses, he focused his questioning on who was in charge of SnoOwl and when.

In reference to the Sallie Mae request to defer student loan payments, Reddington highlighted that the co-signer, Correia’s father, couldn’t make payments because he was on workman’s comp at the time.

Reddington characterized Correia highlighting more expenses as personal, rather than business, as “erring on the side of caution,” but Lemanski disagreed.

Reddington suggested a Valentine Potomac cruise could be considered a business expense if he was “talking up” his business. Lemanski said no, you can’t just “mention” your business name while on a personal excursion and get it to qualify as a business expense.

Redddington asked about the Birds-Eye View helicopter tour from Middletown, R.I., that cost a little over $200. He suggested an entry a day or so later shows that the helicopter company became a “customer”. She countered by saying it was just the way it showed up on the SnoOwl bank statement.

Reddington pointed out on July 27, 2015, a check was deposited for $3,000 in the SnoOwl account and an invoice was submitted with payment to the software company following that deposit.

Earlier this week, jurors heard testimony that SnoOwl earned no actual revenue, so it stands to reason it had no “customers.” Lemanski said there were no business records produced that showed there were any SnoOwl customers.

Reddington classified the SnoOwl records as sloppy. Lemanski in turn said they were incomplete.

Hafer, in redirect, asked her if the expense for the Mercedes down payment was classified as an auto and she said no, it was classified as a software expense. Reddington then asked whose handwriting said it was a software expense, and Lemanski replied that it was the accountant, Charest’s — however, Charest testified Wednesday that it was Correia who told him the $10,000 was for “software technology.”

SnoOwl portion of case is over

The trial ended for the day, marking the end of the SnoOwl portion of the case. Testimony will resume Monday at 9:30, and will focus on the marijuana business extortion and bribery charges.

The judge told the jury that the trial is moving along faster than expected, so he believes testimony will take place next week and the case could be in the hands of the jury by the following week.

What we learned yesterday

After several days of pretty technical testimony about app development procedures, business plans and legal documents, Wednesday’s testimony was downright juicy.

Correia’s ex-girlfriend, Natalie Cleveland, was questioned at length, via Zoom, about gifts she received from Correia, as well as lavish trips and meals the two enjoyed during the three and a half years they dated.

More:Jasiel Correia trial: Ex confirms lavish gifts, accountant details phony business expenses

In all, Cleveland confirmed $32,000 worth of expenses, which included Tiffany jewelry, two Burberry coats, a Kate Spade handbag, Christian Louboutin high-heeled shoes, as well as trips to Washington, D.C. (where Cleveland lived at the time), Boston, Providence, Vancouver and Hawaii, and expensive dinners at places like The Chanler Cliff Walk in Newport.

Prosecutors allege that Correia stole investor money to pay for these items.

Next up was Swansea accountant Terrence Charest, who was granted immunity for his testimony. Charest was hired by Christopher Carreiro, a Swansea selectman who was acting as Correia’s attorney at the time, to “clean up” the SnoOwl books.

Charest said he could never get the proper financial information he needed to do his report. However, he noted that there were several inconsistencies in the SnoOwl books. For instance, a $10,000 car down payment was listed as “software technology” and a trip Correia took with three friends was listed as a “tech conference.” As well, there was a meal at Gulliver’s Tavern listed, but that is actually the legal name of the Foxy Lady strip club in Providence.

Reddington took issue with the offer of immunity. “You didn’t do anything wrong, did you?” he asked Charest. Charest agreed, but said he requested it upon advice from his lawyer.

Melissa Ahaesy, former director of the now-defunct Fall River Children’s Aquarium, and Flint Neighborhood Association President Carlos Cesar both testified about charitable donations their organizations received from Correia, or from Correia and his family, that were actually from the SnoOwl account.

From the notebook

So much is revealed at trial, and not all of it can make it into our story each day, so we are trying to include these interesting tidbits for our readers each day.

A “long” relationship: When Reddington attempted to characterize their relationship as “intense,” Cleveland countered, “It was a long relationship.” When asked how she thought Correia was able to pay for so many plane tickets, hotel stays, etc. Cleveland — echoing statements from others who’ve testified this week — said she assumed he had a lot of money from the sale of his FindIt Networks, to the tune of several hundred thousand dollars. You’ll recall, his partner in that business, Alec Mendes, said they never made much money at all.

Sometimes thrifty?: When questioned about his Mercedes, Cleveland dismissed it as being a “bottom of the line” model. Also, she noted that sometimes, during Correia’s visits to Washington, they would stay at the more expensive Willard Intercontinental for a few days, then move to a less expensive hotel.

Unusual payment methods: Cleveland confirmed that Correia often paid for these expensive items using a mix of half cash and half credit cards.

Strip clubs for business deals: Reddington asked the accountant, Charest, if it’s unusual for businessmen to take clients to strip clubs. “It happens,” Charest admitted. Though he noted that Correia would only have been able to write off 50% of the expense.

Stickers and fliers: Reddington seemed to suggest that perhaps the hotel stays and even the donation to the Flint Neighborhood Association could have involved some SnoOwl business — he hinted that Correia dropped fliers at the hotels in Washington, and even placed stickers on windows of Flint businesses during a tour of the neighborhood with Carlos Cesar.

Ping-pong tables: Mill owner Pat Tod testified that she did visit 1Zero4 Business Academy, the business incubator Correia ran on Anawan Street, and saw some evidence of other businesses working in the space, but she also noticed a ping pong table.

What’s SnoKimo: Another business entity was mentioned briefly during testimony Wednesday. Charest was questioned about some entries in the financial records for SnoKimo. A quick check of Correia’s LinkedIn page shows he was a co-owner of SnoKimo from 2012 to 2014: “We are a high end web development and marketing company. We specialize in everything web related and create beautiful custom websites, databases, mobile apps, and mobile websites. We operate a US based office as well as an office in Nepal and India.” Yesterday, Sergio Arias, a North Attleboro jewelry store owner, testified that he hired — and paid — Correia to build a website for him, however Correia never made good on it.

“Do you know who I am?”: Arias also testified that he ran into Correia at a club in Providence. He told his friend that Corriea had ripped him off, so Arias’ friend confronted Correia. According to Arias, Correia said, “Do you know who I am? I’m a government official.”

More Zoom pitfalls: So far, each day this week there have been 250 to 300 viewers logging in to watch the trial remotely. Despite several reminders, both from the judge and from the court spokesperson, to keep cameras off, some viewers still get tripped up, including one very hairy, shirtless observer who was caught on camera Wednesday. As well, again despite warnings from the judge, Reddington got caught on a “hot” mic calling someone an “a**hole.”