The highest individual income tax rate in Arkansas will decrease from 6.6% to 5.9% starting today.

The cut is part of Governor Asa Hutchinson’s plan, approved by the 92nd General Assembly and the Governor at the 2019 ordinary session under Law 182, to lower the highest individual income tax rate over two years. The first reduction was 6.9% to 6.6% on January 1, 2020.

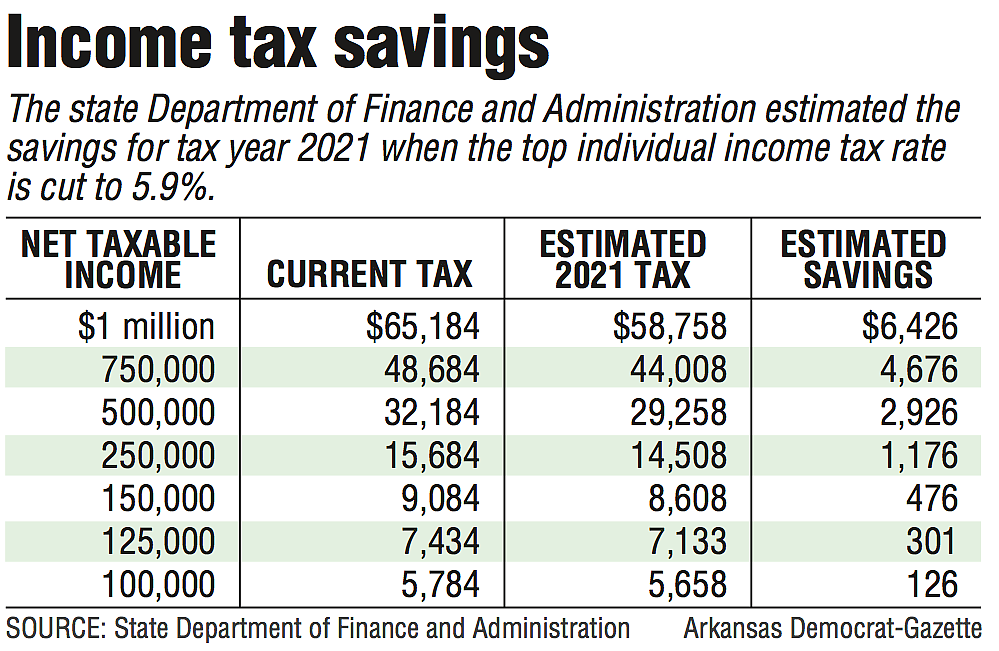

According to Scott Hardin, a spokesman for the state’s Department of Finance and Administration, around 200,000 taxpayers with annual net incomes of more than $ 82,000 are expected to cut their income taxes by a total of around $ 46 million.

The current tax rate of 6.6% applies to income over $ 82,000 in tax year 2020, while income from $ 8,301 to $ 82,000 will be taxed at a maximum rate of 5.9%, he said.

The cut for the 2021 tax year means that for taxpayers with net income greater than $ 82,000, the 5.9% rate will apply to their total net income of at least $ 8,301, Hardin said.

The 2021 income amounts will be adjusted slightly to match the consumer price index and the exact amount will not be known until September 2021.

Hutchinson said around 1.3 million Arkansas taxpayers have benefited from income tax cuts since he became governor in 2015.

“A reduction in the individual income tax rate will benefit every Arkansan,” he said in a written statement. “It allows more of their hard-earned money to stay in their pockets and not be sent to the government. This means that individuals can save more, spend more and have more control over their future and qualify for life.”

Hutchinson said a lower individual income tax rate has resulted in higher-income people returning to Arkansas.

“The specific information is confidential,” he said. “In addition, it was an additional sales factor when we recruited industry for our state.”

State officials have forecast that Law 182 will reduce general government revenues by about $ 97 million a year after it is fully implemented.

Law 182 also cut the number of parentheses on the upper income tax table from six to four in 2020 and will then decrease the number of parentheses to three today. A maximum of 5.9% versus 6% was achieved for middle-income people.

The Treasury Department estimated 579,000 taxpayers would receive a Law 182 tax cut, sponsored by Senator Jonathan Dismang, R-Searcy.

Treasury and Administration officials originally projected Law 182 to cut revenue by $ 25.6 million in fiscal 2020. Another $ 48.5 million in the current fiscal year 2021; and another $ 22.9 million in FY 2022. Fiscal years begin July 1st.

The 182 bill required three-quarters approval in the 35-member Senate and 100-member House as it raised individual income tax rates for some taxpayers, despite state officials saying it would not raise income tax. The measure cleared the Senate 28-5 and the House in an 82-14 vote.

Some Democratic lawmakers who opposed the measure said the money spent on the tax cut should instead be spent on other uses, such as more funding for preschool programs.

“It is a lot of lost revenue that is helping the wealthy, high-income earners,” said Bruno Showers, senior policy analyst with Arkansas Advocates for Children and Families.

Act 182 is Hutchinson’s third reduction in individual income tax rates since his appointment as governor. The others reduced taxes on lower and middle income.

In 2015, lawmakers enacted Hutchinson’s plan to cut taxes for those with taxable income between $ 21,000 and $ 75,000. According to the finance department, the change affected roughly 500,000 taxpayers and reduced revenue by roughly $ 102 million a year.

In 2017, lawmakers approved Hutchinson’s plan to reduce taxes for those with taxable income up to $ 21,000 per year. Around 221,000 taxpayers were affected by the cut, according to the Treasury Department, and revenues fell by $ 50 million annually.

The highest individual income tax rate in Arkansas of 5.9% will be the 22nd highest in the nation, said Katherine Loughead, senior policy analyst at the Washington, DC-based Tax Foundation.

In the surrounding states of Arkansas, neither Tennessee nor Texas have individual income taxes.

Hutchinson has repeatedly said that he ultimately wants to bring the highest single rate down to 5%.

“We can cut our income tax rate to 4.9% or 5% without increasing taxes like sales or real estate,” he said. “Then we will be competitive because other countries have higher real estate taxes and other duties.”

MORE INCOME TAX CUTS

Turning to the regular 2021 session, Hutchinson said, “There will be additional tax cuts and I look forward to working with the legislature to determine exactly what they will look like.

“My priority has always been to lower the individual income tax rate,” he said.

In November, Hutchinson proposed that by 2021 lawmakers lower the highest individual income tax rate for new residents to 4.9% over a five-year period, with a goal of raising the highest tax rate for everyone else to 4.9 within five years % to lower.

The governor also proposed allocating $ 50 million annually to income tax cuts for low- and middle-income Arcansans. He said this will help pave the way for a later cut in the top tax rate.

Finance has forecast that lowering the highest individual income to 4.9% would ultimately lower revenue by about $ 275 million per year.

Pro Tempore Senate President Jim Hendren of R-Sulfur Springs said: “I would be surprised if there was a dramatic tax cut in the middle of the pandemic.

“I think most of us feel pretty blessed that our budget is as high as it is and that we have long-term reserve [fund]”He said, adding that Hutchinson’s plan to move excess revenue of $ 100 million into the fund has government support.

The long-term reserve fund, a kind of savings account for the state, has a balance of $ 185 million. Hutchinson has plans to increase this fund to $ 420 million by the end of fiscal 2023.

Hendren said, “The shiny object that everyone always focuses on is the highest individual income rate.

“Whether that makes the most sense or not is debatable,” he said. “It’s still a question of how we can make our tax laws a little less regressive because of the high sales tax rates we have.”

Hendren said he would eventually like to bring the state’s highest individual rate below 5%.

Speaking of tax cuts, Rep. Lane Jean, R-Magnolia said, “I’m not sure we have too many more areas to explore in this environment.

“I think we have to do what we can and what we can,” he said.

Jean, co-chair of the Joint Committee on Budgets, said there was a contingent of lawmakers looking to further lower the highest individual income tax rate of 5.9% by 0.1%, or 0.2%.

He said another group of lawmakers are looking to create a state-earned tax credit for low- and middle-income Arcansans. and another contingent wants to remove the low-income tax table.

“I think we just have to get these things out of the way during the session,” he said. “I feel that [earned income tax credit] has an uphill battle. “

Legislators appear to have more support for getting rid of the low-income tax table and lowering the top tax rate than for creating a state-earned income tax credit, Jean said. “We’ll just have and see the debate.”

For the meeting, Joe Jett, chairman of the House Revenue and Taxation Committee, filed R-Success, House Bill 1011 to remove the tax table for those with net incomes up to $ 22,200. Jett estimates that doing so would reduce sales by about $ 84 million a year.

Hendren submitted Senate Draft 2, which he estimated would bring low- and middle-income Arkansans about $ 100 million annually in income tax breaks. The bill would be funded with tobacco tax increases. Similar laws narrowly cleared the Senate in 2019, but the House Revenue and Taxation Committee hasn’t voted on it.

SB2 would create a refundable tax credit for government-earned income, increase the standard withholding, and remove one bracket from the tax table for those earning up to $ 22,200 a year. It would also impose a special excise tax on cigarettes and a privilege tax on e-cigarettes and vaping products.

“Taxpayers get the shaft out of big tobacco companies when it comes to healthcare costs, and … it is documented that taxpayers pay about $ 400 million or $ 500 million in healthcare costs that are directly related to tobacco-related diseases and I think that needs to be rebalanced because the people who pay the heaviest burden of it are low-income people, “Hendren said.

He said his bill “is not because I have problems with big tobacco or smoking and people who choose to. But I think if you do, you should be ready to pay the cost of the healthcare system to come along with it. “

“But I’m not kidding myself that there is a shared belief in the Republican Party [the earned income tax credit] is welfare and is not based on reality, but it’s there so it won’t be easy to get over, “said Hendren.

Senator David Wallace, R-Leachville, submitted Senate Draft 10, which would create a refundable earned income tax credit equal to 10% of the federal income tax credit.

“I support the idea of EITC because I like to see that we give tax breaks to low-income families, and that is exactly what this bill does. If the tobacco content makes my bill unfeasible, I certainly support what it is trying to do,” said Hendren and referred to Wallace.

Senator Jimmy Hickey, R-Texarkana, who will temporarily replace Hendren as Senate President at the beginning of the January 11 session, said, “We need to look at Senator Hendren and Rep. Jett’s proposals.”

Hickey and Jean said the governor’s proposal to lower the highest individual income tax rate for new residents to 4.9% had not received much support in the legislation.

Lowering the individual income tax rate

Income tax savings