On March 2, the IRS updated the Frequently Asked Questions (FAQ) about virtual currency transactions. The new FAQ stipulates that taxpayers whose only crypto transaction involves buying a virtual currency with a real currency will not need to answer yes to the question on the front page of the 2020 IRS Form 1040. This instruction is in direct contradiction to simply reading the simple cryptocurrency question highlighted in red here:

2020 IRS Form 1040 page 1

GMM

I’ve written about IRS enforcement on Crypto account holders here, here, and here before. Uncovering crypto account holders is an integral part of increased enforcement in this area, and as I explained just two weeks ago, the IRS is focused on criminal and civil enforcement in this emerging tax area.

Both the 2020 IRS Form 1040 and Instructions for 1040 require that a taxpayer who has made a virtual currency transaction must select the Yes check box next to the question on page 1 of Form 1040. However, the instructions for 1040 provide a little more color. Explain: “A virtual currency transaction does not involve holding virtual currency in a wallet or account, or transferring virtual currency from one wallet or account you own or control to another you own or control. ”

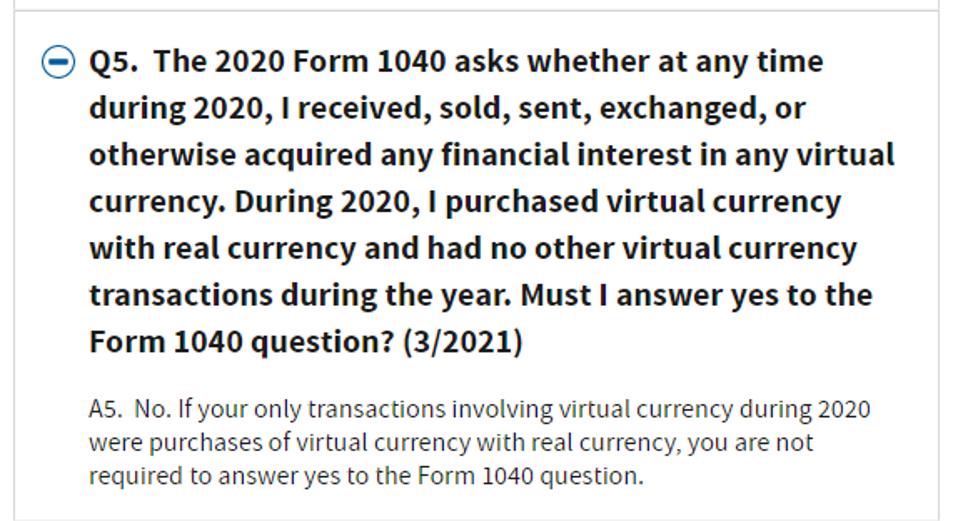

The FAQs released today provide:

Q5 of the IRS Virtual Currency Frequently Asked Questions

GMM

Should crypto account holders who bought but not sold virtual currency in 2020 answer “no” to the question based on this FAQ and 1040 instructions?

I wouldn’t bet a single bitcoin on it.

First, taxpayers cannot rely on informal IRS guidelines such as Frequently Asked Questions (FAQs) and even the Internal Revenue Guide. Yes, you read that right. The IRS may and will publish guidelines in the form of FAQs and the Internal Revenue Manual to help taxpayers (and revenue agents) navigate the web of tax law. But there is an abundance of case law that says taxpayers have no “rights” and cannot try to enforce them. Eaglehawk Carbon, Inc. v USA, 122 Fed. Cl. 209, 221 (2015) (with reference to the fact that the IRM provisions “it is beyond all limits”[ ] have no legal force ”); Fargo v. Commissioner, 447 F.3d 706, 713 (9th Cir. 2006) (with reference to the fact that “[th]The Internal Revenue Manual is not final and does not give taxpayers any rights. “); Valen Mfg. Co. v USA, 90 F.3d 1190, 1194 (6th Cir. 1996) (referring to [“[t]However, the terms of the manual govern only the internal affairs of the Internal Revenue Service. You do not have the power and effect of the law, “quoted United States v. Horne, 714 F.2d 206, 207 (1st Cir. 1983)); and Marks v Commissioner, 947 F.2d 983, 986, n.1 (DC Cir. 1991) (with reference thereto [i]It is well regulated … that the provisions of the [I.R.M.] are a directory rather than compulsory, are not codified regulations and clearly do not have the power and effect of the law. “).

Second, answering no to the question when the actual answer is yes based on the Frequently Asked Questions (FAQ) or instructions on the 1040, while technically correct, may result in adverse consequences. Simply buying a virtual currency does not result in a taxable event. Even if there is no tax due in 2020, if a taxpayer answers no in 2020 based on the FAQs but then fails to file a 2021 tax return or a tax return without a crypto transaction, you can be sure that the IRS will argue The answer of no in 2020 was evidence of the intention to hide the crypto. And the Justice Department’s Tax Department too. Even if a taxpayer is confirmed later, simply going through a civil or criminal law review by the IRS can be time consuming, emotionally charged, and costly.

While common sense says it should be perfectly okay to answer “no” based on the frequently asked questions, as a tax attorney defending clients in civil and criminal tax disputes with the IRS, I will advise my clients, bought but not sold the crypto, unless there is a compelling tax-free reason not to do so, answer yes.