Highlights

- After Inauguration Day on January 20, 2021 and with the seat of the two newly elected Democratic Senators from Georgia, the Democrats will have control of the White House and both Congress Houses for the first time since 2011.

- However, the tight margin that the Democrats keep both houses in will limit which tax proposals can become law, either through regular order or through a budget balancing process.

- This warning from Holland & Knight describes the tax policy priorities of President-elect Joe Biden and the Congressional Democrats as they are now known, what the composition of Congress may mean for those priorities and the outlook ahead.

After inauguration day on January 20, 2021 and with the seat of the two newly elected Democratic Senators from Georgia, the Democrats will have control of the White House and both Congress Houses for the first time since 2011. Democratic control in Congress will be very tight, which will limit legislation in both houses. In the US House of Representatives, Speaker Nancy Pelosi (D-Calif.) Will lead a majority of 11 members, but will also lose several members through appointments in the Biden administration, which may limit her majority until special elections in these districts. The 50 Democratic Senate (technically 48 Democratic members and two independents who will meet with Democrats) and 50 Republicans will have a Democratic majority only through Vice President Kamala Harris as the groundbreaking voice in her role as Senate President.

Among other things, the composition of the 117th Congress will restrict which tax proposals can become law either through regular regulations or through a budget comparison (see below). This warning from Holland & Knight describes the tax policy priorities of President-elect Joe Biden and the Congressional Democrats as they are now known, what the composition of Congress may mean for those priorities and the outlook ahead.

Expand tax proposals

Overall, President-elect Biden’s tax priorities are aimed at achieving more progressive tax legislation, including tax increases for individual taxpayers with incomes in excess of $ 400,000, extending certain tax benefits to low- and middle-income individuals, increasing the corporate tax rate, and expanding credits for renewable energy . By some estimates, his proposals would add nearly $ 4 trillion in federal revenue. The president-elect recently announced his COVID-19 aid package, which includes tax proposals to help individuals and change certain vacation requirements for employers. Holland & Knight will stay informed of developments as soon as these suggestions become clearer.

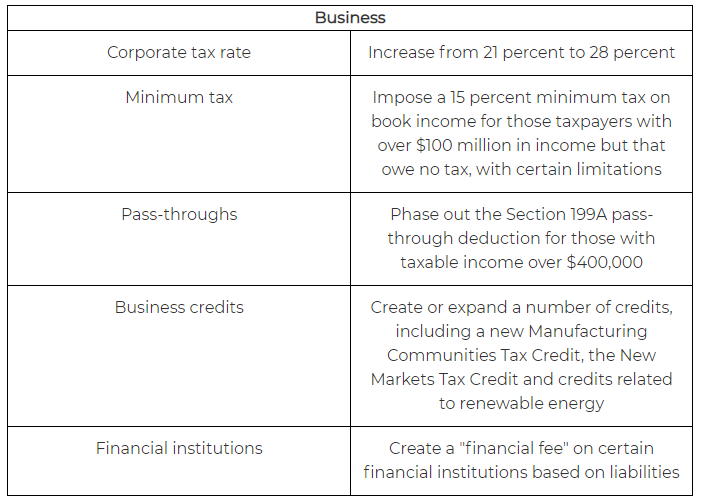

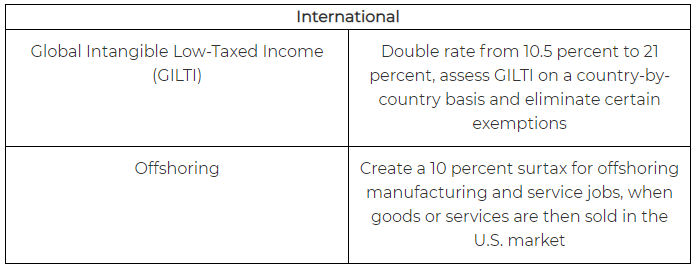

The main components of the Biden campaign’s tax proposals include:

Budget reconciliation

Given the small Democratic majority in Congress, any tax legislation will have two avenues to become law. It must either have near-unanimous democratic support in the House of Representatives and bipartisan support in the Senate (in regular order) or go through the budget voting process. (See also earlier warning from Holland & Knight, “Senate Elections Make Budget Voting a Potential Instrument in 117th Congress,” Jan 7, 2021.) Importantly, the Senate budget vote process would require unanimous democratic support. Achieving such support is likely to be difficult given the increasing power of democratic members from moderate and conservative states.Tax Policy and Congress ProcessAnother problem is that many provisions of the 2017 Republican Tax Cut and Employment Act (TCJA) will expire without action by Congress. For example, all changes to individual tax regulations will expire by 2025. While TCJA’s terms and conditions are all permanent, a handful of them will become more expensive for corporate taxpayers as early as 2022.

The Budget Voting created in the 1974 Budget Act is a congressional process in which both Houses pass a budget resolution setting only budgetary targets for a fiscal year, including targets for income, expenditure and debt. The budget resolution and the ensuing Law of Reconciliation are not subject to the 60-vote filibuster threshold in the Senate and can be passed by a simple majority in both houses of Congress. The resolution contains voting instructions for certain committees to report legislation that brings applicable law to the stated objectives of the resolution.

This budget reconciliation process is governed by several rules that affect both the soil review process and limiting the inclusion of “foreign affairs”. In the Senate, a motion to continue the reconciliation measure is not controversial – that is, it is not subject to the filibuster. The debate on the voting bill itself is also limited to 20 hours to ensure that it is examined in a timely manner.

The limits for foreign affairs result from the “Byrd rule”, which was created by the former Senator Robert C. Byrd (DW.Va.). Under the Byrd Rule, any Senator can ask a Rules of Procedure to remove “foreign matter” in reconciliation laws or directives, and the rule can only be waived with the assistance of three-fifths of the Senators. The Byrd Rule’s specific definitions of “foreign matter” that could affect tax law are:

- It does not change the income or the conditions under which income is collected.

- This leads to a decline in sales if the commissioned committee does not follow its instructions.

- This leads to a change in income that is only related to the non-budgetary components of the provision.

- This would increase the deficit for one financial year beyond the “budget window” covered by the transitional measure.

Of these, one of the most important factors that can affect tax measures in a transitional law is the prohibition of tax policies in which revenue changes “only randomly” relative to the non-budgetary (ie political) components. Another reason is whether a tax change would reduce revenue beyond the reconciliation invoice’s budget window.

These components of Byrd’s rule often limit what tax recorders include in a reconciliation law and also allow the minority to remove provisions by seeking a Senate MP’s decision.

It should be noted that some have suggested that the Senate abolish the legislative filibuster, removing the need for budget reconciliation and its limits. Given the 50:50 split in the Senate and the reluctance of more moderate and institutionalist senators to change the Senate process so fundamentally, this path currently seems unlikely.

Along the road

Though the Congressional Democrats and the Biden Campaign put significant emphasis on the tax proposals, 2021 promises to be a busy year for Congress and the Biden government on time-sensitive issues such as fighting the COVID-19 pandemic, economic stabilization and recovery as well domestic instability.

There is no doubt that changes to the tax code are imminent. Businesses and individuals should pay close attention to how the proposals and congressional processes come together in the coming months. Waiting for a tax measure to be written or discussed is often too late. Working with the administration and members of Congress early on can be critical to informing policy makers and assisting in the formulation of guidelines that may become law.