Annuities offer many benefits to customers, but those benefits are particularly aimed at individuals.

Annuities are often tailored for retired customers, and these are most often looking for a predictable source of income or a guarantee of return on investment. Choosing the right pension based on goals and risk tolerance is a personal decision.

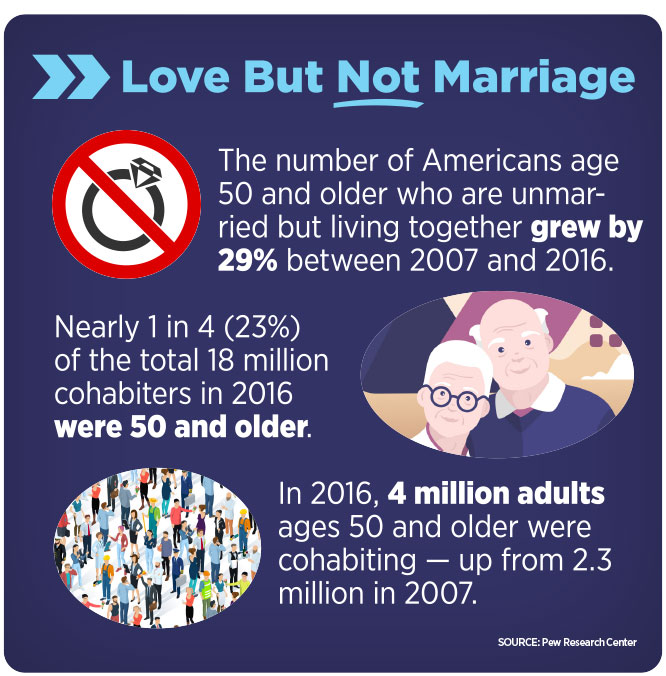

Despite this individual focus, there are ways that marital status can be considered when choosing pensions, as any non-marital beneficiary may face complications that marital beneficiaries do not. As of 2018, 45% of 47.5 million Americans 65 and older are unmarried, reports LIMRA. Knowing this, there are factors that advisors can consider for clients – for example, those who are partners but not married – looking for a retirement. In these conversations, consultants can address the following topics in order to train clients and better position and clarify the benefits of annuities.

Considerations for Unmarried Couples

The idea of buying an annuity may be attractive to unmarried couples, but there are considerations that need to be communicated. The tax law currently provides for the “continued spouse” of a pension to be paid to a surviving spouse if the spouse is named as the beneficiary. This means that in cases where a surviving spouse is receiving a qualified or unqualified pension, the surviving spouse can continue the contract on their own behalf as if they were the original owner. While the income from an annuity can be used, it is up to the couple to decide, determining an illegitimate beneficiary is much more complicated when the owner of the annuity dies.

However, unmarried couples can face complicated tax hurdles due to applicable tax laws. Inherited pensions – if the beneficiary inherits the pension after the death of the pension recipient – are considered taxable income, unless the pension comes from a state-approved spouse. Unlike spouse recipients, non-spouse recipients cannot simply take ownership, which makes transferring funds difficult. The illegitimate beneficiary must also pay income tax on the profit of the contract, which is based on the individual’s tax rate. Without prior planning, these taxes can weigh on a significant portion of wealth.

If a counselor is working with an unmarried couple at the beginning of the retirement buying phase, it will be in your client’s best interest to help the named beneficiary understand the limited options available for paying and distributing death benefits if the couple chooses this avenue. By providing all of the considerations and likely challenges clients faced through an illegitimate beneficiary, counselors can help them avoid unpleasant financial implications and unnecessary costs.

Positioning of pension benefits

This is also an opportunity for counselors to help clients understand that every pension is truly meant for the living individual. Annuities are a tax-deferred method that allows money to grow safely and create a lifelong stream of income for the annuity owner. Focusing on the true intent and utility of annuities can help realign the conversation.

Consultants can explain that fixed pensions are a long-term savings plan for clients, with an integrated future income stream that can complement retirement income. Client needs can be matched with either a fixed immediate or a fixed deferred annuity – with the deferred option offering an option for multi-year guarantee annuities or fixed indexed annuities.

Assuming that each of these elements match a target client, advisors can better identify which pensions best fit the client’s situation – and each person in the relationship may have a different situation. It is an opportunity to show how they can benefit from individual annuities.

With no annual contribution cap on an unqualified annuity, customers can save more money for retirement and make up for lost time on other traditional retirement plans like 401 (k) s and individual retirement accounts when they start saving later in life. This factor can be of value to a couple who have pursued diverse career paths and may be looking for a way to make profits in order to better match their partner’s level of savings.

The many other benefits associated with pensions, such as the security of building savings, assuring a lifelong stream of income, tax latency status, and others, can be made available to unmarried couples to cater to individual needs.

After counselors remind their clients that it is difficult for anyone other than a spouse to seamlessly adopt an annuity contract and communicate the benefits of annuities, they can help unmarried clients choose the right annuity that suits their financial needs.

Selling to the individual

Counselors can approach a conversation with an unmarried couple by selling to each individual. In these conversations, it is imperative to help customers understand the challenges noted earlier. While being married may be easier when it comes to naming your partner as a beneficiary, finding the right pension for each person is crucial.

Consultants can assist clients in purchasing two individual contracts, with each annuity specifically tailored to each client’s preferences and goals. This means that each person receives a personalized investment option. It can be explained similarly as if they were each buying their own vehicle. Yes, the car serves a similar purpose, but has the characteristics and characteristics preferred by each person.

During these conversations, the counselors attempt to understand each client’s long-term financial planning goals, as well as the goals they have as a couple, to help them choose two annuities. Since each annuity has its own benefits, customers will prioritize these benefits differently. Consultants can recommend the right adjustment based on when and how long to start payments, what their level of risk tolerance and expected contribution are – which may not be the case in an individual partnership.

Annuities are a safe way to bring savings into retirement. Their main features offer many benefits that support the goals of clients regardless of their marital status. However, when unmarried partners seek advice from an advisor regarding pensions, counselors can help by providing information, context, and clarity about the purpose of pensions and how best to work.