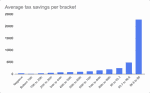

The savings made by Montana taxpayers by income bracket from the Tax Cut and Jobs Act of 2017, compared to what they would have paid without the law.

David Erickson

Those with the highest incomes in Montana saw a $ 1.5 trillion drop in the 2017 tax cut and Republican jobs bill, according to the Montana Treasury Department.

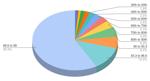

As of tax year 2018, a very small portion of Montana’s population, the 3.4 percent of income recipients, had to withhold nearly $ 359 million more in federal income taxes thanks to the law. Those 15,709 individuals each saved an average of $ 22,837 in federal income tax.

For the 296 Montana taxpayers who earn over $ 2 million annually, the savings were even more apparent. These top-income groups combined saw more than $ 67 million in their paperback books, representing an average saving of over $ 226,000 each. The total income of these 296 people was well over $ 2 billion, and together they paid $ 532.5 million in taxes. Without the law, combined, they would have owed nearly $ 600 million in taxes.

Average Tax Savings Per Bracket by Montana Taxpayers from Tax Reduction and Jobs Act 2017.

Matt Neuman, for the Missoulian Montana Department of Revenue data

2019 data are not yet available.

The Tax Cuts and Jobs Act of 2017 was the most significant revision of tax legislation in more than three decades. Billed as a driver of economic growth by Republicans but viewed by Democrats as an increase in both wealth inequality and the federal budget deficit, it narrowly got through the US Senate on party lines.

There is no consensus on the impact of the bill from tax analysts. However, many point out that it did indeed disproportionately benefit the rich, while also significantly increasing the nation’s debt, as it was not accompanied by a corresponding spending cut. Others argue that this boosted business and household incomes, and boosted employment growth.

The law had far-reaching consequences, affecting housing construction and political power. For example, if you are rich, the savings and incentives make it even more attractive to buy a second home or donate to political campaigns.

Almost all taxpayers have received a tax cut, but the amount varies and the savings disproportionately benefit those in the upper income brackets.

The bottom 96.6 percent of Montana income earners, 461,263 taxpayers, saved an average of $ 1,361 each because of the new law.

Someone making less than $ 7,061 a year (roughly 47,000 taxpayers in Montana) saw an average saving of $ 154, while someone who made between $ 155,000 and $ 217,000 saved an average of $ 4,859.

Put another way, the top 3.4 percent of income earners in Montana earned $ 359 million, nearly 41 percent of the total tax savings. Meanwhile, the bottom 96.6 percent of the income earners shared $ 524 million and the remaining 59 percent of the total savings.

The Missoulian filed a request with the Montana Treasury Department for public records for the numbers that have access to federal income tax data.

Wealth inequality has grown steadily In the United States, the wealth gap between higher-income families and lower-income families has been widening since the 1980s, according to the Pew Research Center.

A pie chart showing the average tax savings per bracket as a percentage of the total.

David Erickson

The Law on Tax Cuts and Employment contained numerous provisions, some of which were supported by both sides of the political gang, and in some ways simplified tax legislation. One of the major changes was a 40 percent cut in the corporate tax rate.

The law also had incentives, which some analysts said were more focused on helping the rich buy homes, including buying second homes.

For example, the new law reduced the mortgage interest deduction limit from $ 1 million to $ 750,000 for new home and second home loans.

This has helped people with high incomes gain disproportionately from being able to buy second homes, according to a paper by Scott Eastman and Anna Tyger of the Tax Foundation last year.

In her words, “Research suggests that the withdrawal does not increase home ownership rates. However, there is evidence that the withdrawal increases housing costs by increasing the demand for housing.”

In 2018, less than 4 percent of taxpayers who earned less than $ 50,000 claimed the deduction, and those taxpayers received less than 1 percent of the total tax expense. Taxpayers earning more than $ 200,000 took up 34 percent of the claims and took 60 percent of the benefits.

“The benefits of home mortgage income deduction are primarily for high-income taxpayers, as high-income taxpayers tend to list more often and the value of the HMID increases with the price of a home,” they write. “While the overall value of HMID has decreased due to the TCJA, the benefit portion is now more focused on high-income taxpayers as more taxpayers choose the more generous standard allowance.”

They therefore argue that people who buy houses they do not live in and who do not borrow large amounts now have greater financial gain than those who borrow and live in the houses they buy.

“The TCJA’s lowering of the HMID cap increased the effective marginal tax rate for condominiums, particularly debt-financed homes,” concluded Eastman and Tyger. “These changes penalize homeowners who rely on debt to finance their homes and increase the cost of condominium savings.”

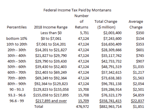

Distribution of mortgage interest deduction entitlements by income group.

According to the Missoula Organization of Realtors, luxury home sales in the Missoula area have seen a sharp surge recently. The MOR started tracking sales of homes priced above $ 750,000 this year as there were so many more sales in this area compared to previous years.

Brint Wahlberg, a local real estate agent who tracks data on the local market, told the Missoulian in September that the Missoula area has no longer seen a flood of high-priced homes.

“High dollar homes have fallen into a normal utility area,” he said.

Local real estate agent Rebecca Donnelly told the Missoulian in September that home buyers outside of the state are primarily looking for between $ 750,000 and $ 2 million.

Home demand has largely outpaced supply in the past six years, but has increased sharply in recent years.

From January through September 2016, the average home sales price in Missoula County was $ 252,790 and for the same period in 2020 was $ 340,000, an increase of 34.5 percent. The digital real estate company Zillow shows that real estate values in Montana have increased 28 percent since the beginning of 2016.

The pandemic and work-from-home trends likely contributed greatly to this trend.

David Erickson

According to Robert Sonora, an economist with the University of Montana’s Bureau of Business and Economic Research, historically low interest rates have also increased demand for home purchases.

“That drives a lot of this stuff,” he said. “For the foreseeable future, the (Federal Reserve) will keep rates low while this COVID thing is going on and the stimulus package fails.”

Sonora said proponents of the tax cut and employment bill said it intended to increase corporate investment so they could hire more people.

“But that didn’t work out and it wasn’t unexpected at all,” he said.

The Impact of the 2017 Tax Reduction and Employment Act on Montana Taxpayers Federal Income Tax, by Income Range Percentile.

David Erickson

Sonora cites a study conducted by the University of Chicago that found that many Fortune 500 companies were taking advantage of the TCJA in share buybacks or overcompensation management rather than investing in hiring or capital.

“Goldman Sachs ended up doing a study of what companies did with the corporate tax break, and I think they put 15 cents on the dollar in workers and / or equipment,” said Sonora. “Most went to share buybacks and to shareholders. Which was totally expected, which is partly why we got the stock market going. And there is a divide between financial markets and the real economy, right?”

Luxury home sales in areas such as Missoula’s Mansion Heights neighborhood have seen a sharp surge recently.

TOM BAUER, Missoulian

You have to be logged in to react.

Click on a response to sign up.

Subscribe to our Daily Headlines newsletter.