Representative image of the Indian currency Photo: Dhiraj Singh | Bloomberg

Text size: A- A +

W.Although much of the analysis of the Union’s 2021-22 budget has focused on the bigger picture, some of the less obviously significant measures also deserve attention and attention. This blog focuses on one measure in particular – reducing the time the income tax department has to “reopen” tax returns and its importance to the rule of law. In particular, the proposed shortening of the limitation period in accordance with Section 149 of the Income Tax Act of 1961.

Typically, once a taxpayer has filed their tax return, the government takes their word for it as to how much tax they owe and reimburses any surpluses. If the government finds that the taxpayer has actively withheld information that could increase the tax payable, they “raid” (technically “search and request”) and review the declarations submitted based on the recoveries made.

Also Read: What Series of Extensions Means for CBDT Chairmen Under Modi Govt

Resolving Tax Differences under the IT Act 1961

However, what if all the information is available but the taxpayer has still paid less tax and the government realizes this after filing the tax returns? For example, the taxpayer might have claimed a deduction because they believed they were entitled to, but not legally. The taxpayer might have treated some income as “business income” and paid tax under the law on it when it was actually “royalty income” and should have paid more tax on it. Note, however, that this cannot be done solely on the direction of the income tax department. You need to have some information that is not yet known in order to reach this conclusion.

Such situations are remedied by the department in accordance with the procedure under Sections 148 and 149 ITG. A notification is served, a hearing is held, and then the “addition” (if necessary) is made based on the procedure. Section 149, however, limits the period within which the ministry can issue a notice to the taxpayer.

Section 149 exists for tax reasons. The taxpayer needs to know that the way he has treated his income is never checked in the indefinite future and lives in the constant fear of endless tax disputes. Similarly, the rule of law also requires that laws create stability and minimize the ability to act arbitrarily. If the government can arbitrarily and unilaterally demand more money from the taxpayer, it violates both the basic principles of taxation and the rule of law.

Also read: “Non intrusive method” to catch tax evaders – Ministry on the move to scan school fees, other payments

Proposed changes to IT law and its implications

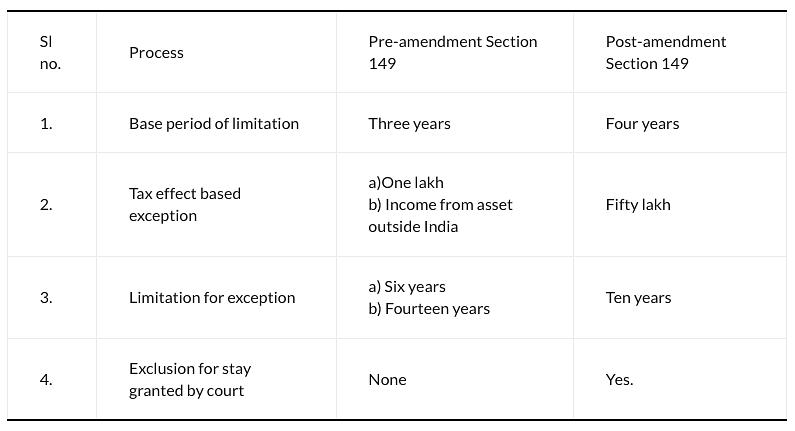

The table below shows the changes proposed in Section 149 of the Finance Act of 2021.

The Section 148 revaluation of income tax returns is a major source of tax disputes, and while the court has repeatedly made it clear that it cannot simply be used to “change mind” it is still widespread to see ascertained assessments simply for that reason reopened because, in the opinion of the evaluator, a different view can be represented in the evaluator’s accounts. Part of the problem here is the perverse incentives created by setting collection-based goals for tax authorities that only encourage them to play with the law quickly and easily.

It is salutary, therefore, that the government has taken a step to tighten the conditions under which notices for reassessment can be issued.

As with much of what the government does, what it gives with one hand it takes away with another. While the changes to Section 149 will benefit most taxpayers, a small number of taxpayers are now doing worse under this provision. In particular, if the government believes that more than Rs. 50 lakhs of income has escaped tax, the limit has been extended from the previous limit of six years to ten years. To be fair, even if the alleged income that is being taxed is more than Rs, this is only likely to have any effect as clarified in the second provision and in previous reviews. 50 lakhs will not be reopened due to this clause.

Tax law is not just the law that gives the government the procedure for collecting the maximum possible taxes on people – it is an important element of the rule of law that no citizen is deprived of property without legal process. The rule of law is not just a trivial barrier for the state – as long as the state follows the procedure, everything flies. It is hoped that the changes to the tax collection process will also be further examined from a rule of law perspective.

Alok Prasanna Kumar is the co-founder and director of Vidhi Karnataka. Views are personal.

This article was first published by the Vidhi Center for Legal Policy.

Subscribe to our channels on YouTube & Telegram

Why news media is in crisis and how to fix it

India still needs more free, fair, non-segregated and inquiring journalism as it faces multiple crises.

But the news media is in a crisis of its own. There were brutal layoffs and wage cuts. The best of journalism is shrinking and making a gross spectacle in prime time.

ThePrint has the best young reporters, columnists, and editors to work for it. To maintain journalism of this quality, smart, thinking people like you have to pay for it. Whether you live in India or overseas, you can do it here.

Support our journalism