Sheldon Adelson, who rose from selling newspapers on Boston street corners at age 12 to one of the most successful luxury resort developers, philanthropists and political influencers of his generation, died Monday night at his home in Malibu, California. He was 87.

Adelson founded and served as chairman and CEO of Las Vegas Sands Corp., the world’s largest gaming corporation, from its inception in 1988. He had been on medical leave from the company since Thursday to resume his fight against non-Hodgkin lymphoma, which he had battled since 2019.

“It is with unbearable pain that I announce the death of my husband, Sheldon G. Adelson, of complications from a long illness,” his wife, Dr. Miriam Adelson, said in a Tuesday statement provided by Las Vegas Sands.

“To me — as to his children, grandchildren, and his legions of friends and admirers, employees and colleagues — he is utterly irreplaceable.”

Under Adelson’s leadership, Las Vegas Sands pioneered the integrated resort model that now dominates the Strip, combining luxury hotel-casinos with convention centers. Adelson’s concept was so popular and financially successful that he became one of the world’s wealthiest people.

Adelson shared that wealth as a generous philanthropist. Along with his wife, he underwrote medical research, a private school, drug rehabilitation clinics and numerous other causes.

Adelson’s conservative values, love for the United States and Israel, and his desire to preserve the strongest diplomatic and cultural ties possible between the nations compelled him to embrace and support Jewish causes. He became one of America’s most influential political megadonors, contributing hundreds of millions of dollars to Republican candidates and conservative PACs over the past two decades.

Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson and his wife, Dr. Miriam Adelson, attend the presidential debate between Democratic nominee Hillary Clinton and Republican nominee Donald Trump at Hofstra University in Hempstead, N.Y., on Sept. 26, 2016. (AP Photo/Patrick Semansky)

Adelson also was unfailingly loyal to the thousands of people he employed.

After the coronavirus pandemic forced Nevada casinos to shutter in March, Adelson continued providing full pay and benefits to all 10,000 Las Vegas Sands Corp. employees and the 1,200 employees working in the resorts’ 14 independently operated restaurants throughout the closure.

“As the son of hardworking, low-income, immigrant parents, I grew up with the same anxiety people across the nation are feeling right now,” he wrote in a New York Post column about his decision to keep paying his employees.

“… I recall one of the most important lessons I learned from my father. He would come home from work — when he could find work, that is — and put loose change in the family pushke (charity box). When I asked why he would give to others when we had so little, he would say, ‘There is always someone whose need is greater than ours.’ ”

As the coronavirus pandemic took hold, Adelson procured 2 million surgical masks for health care providers and first responders in Nevada and New York. He dispatched his personal Boeing 747 to pick up the masks in Guangzhou, China, and deliver them to both states for immediate distribution. The company also donated hundreds of thousands of personal protective suits, equipment and nearly 2,000 coronavirus test kits to Nevada, in addition to significant food and water provisions.

Las Vegas Sands Inc. Chairman and CEO Sheldon Adelson leads media on a tour of The Venetian construction site in 1999 prior to the Strip resort’s opening. (Las Vegas Review-Journal file)

Making way for The Venetian

Adelson created Las Vegas Sands to purchase the legendary Sands Hotel and Casino on the Las Vegas Strip. He then built the Sands Expo and Convention Center adjacent to the property. The combination was an innovative concept at the time, allowing thousands of guests to converge for business events during the day and enjoy the sights, sounds and flavors of Las Vegas when the meetings were done.

Adelson imploded the hotel, built in 1952, on Nov. 26, 1996, and spent $1.5 billion to build The Venetian in its place, complete with a reproduction of St. Mark’s Square and waterways with gondolas and singers in striped shirts, straw hats and red sashes. On tours of the resort before its 1999 opening, an excited Adelson occasionally burst into an operatic refrain of “O Sole Mio.”

The Venetian’s conference-centric strategy “was not just laughed at, but made fun of” before its opening, Rob Goldstein, chief operating officer and acting chairman and CEO of Las Vegas Sands Corp., told the Review-Journal in 2019. “I’d meet people in town and they’d say, ‘What are you guys thinking?’ ”

Adelson opened the Palazzo next door to The Venetian in 2007, integrating the two hotels and convention center into a resort replete with more than 7,000 luxury suites. That model has since been copied again and again on the Strip, with meeting and convention spaces, and their supporting infrastructure, dominating Strip construction in recent years.

“The opening of The Venetian in 1999 was the real beginning of our company’s story, and it also launched a new era of integrated resort development around the world,” Adelson told the Las Vegas Review-Journal in a 2019 statement. “The Venetian’s success in Las Vegas, and particularly our convention-based business strategy, would end up being the basis for our company receiving coveted licenses in Macao and Singapore.”

Adelson opened the Sands Macao in the Chinese enclave in 2004. Then, in 2007, Adelson opened The Venetian Macao, an even more elaborate version of his Las Vegas property and the world’s largest casino. By one estimate, Adelson’s personal wealth multiplied 14 times in the first four years of his company’s Macao operations.

Even when he could afford the finest, perfectly tailored suits and matching jewel-toned neckties and pocket squares, he never lost his love for simple pleasures — especially a good pickle.

“I never thought about becoming wealthy. It never crossed my mind,” Adelson once said. “What really motivated me was to try to accomplish something.”

Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson speaks to students at the University of Nevada, Las Vegas on April 26, 2012. (John Locher/Las Vegas Review-Journal)

Entrepreneurial nature

Sheldon Gary Adelson was born on Aug. 4, 1933, in Dorchester, Boston. Adelson and his three siblings were raised in a one-room tenement by their parents, Arthur, a cabdriver from Lithuania, and Sarah, a seamstress from Wales. Referring to the family’s meager means, Adelson later would quip that his was not a rags-to-riches story because “we were so poor we couldn’t afford rags.”

When he was 12, he borrowed $200 from an uncle and bought a license to sell newspapers on the street. It would be the first of more than 50 businesses he would found — including, eventually, a newspaper. He and his wife, Miriam, launched Israel Hayom in Tel Aviv in 2007, and it quickly became the most-read daily in Israel. He purchased the Las Vegas Review-Journal in December 2015.

“For me, businesses are like buses,” Adelson once said. “You stand on a corner and you don’t like where the first bus is going? Wait 10 minutes and take another. Don’t like that one? They’ll just keep coming. There’s no end to buses or businesses.”

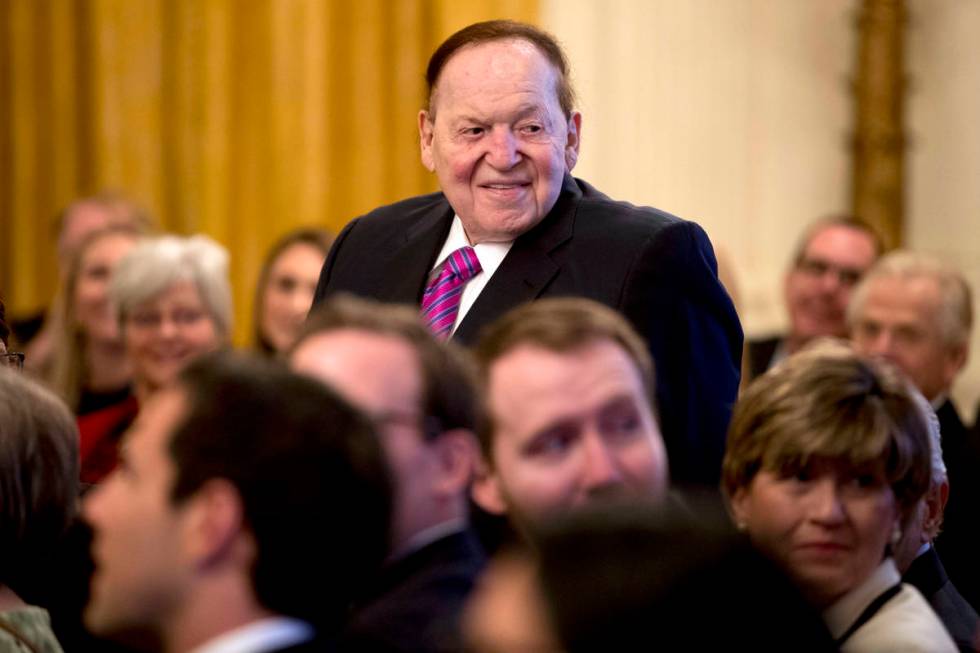

Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson stands as he is recognized by President Donald Trump during a Medal of Freedom ceremony in the East Room of the White House on Nov. 16, 2018. Adelson’s wife, Dr. Miriam Adelson, received a Medal of Freedom. (Andrew Harnik/The Associated Press)

Las Vegas Sands Inc. CEO Sheldon Adelson displays a rendering of the Sands Hotel with the Sands Expo & Convention Center in this undated file photo. When the meeting center opened in 1990, it was the only privately operated convention center in the United States. The Sands Hotel was later imploded to make way for The Venetian and the Palazzo resorts. (Gary Thompson/Las Vegas Review-Journal)

Las Vegas Sands Inc. CEO Sheldon Adelson displays a rendering of the Sands Hotel with the Sands Expo & Convention Center in this undated file photo. When the meeting center opened in 1990, it was the only privately operated convention center in the United States. The Sands Hotel was later imploded to make way for The Venetian and the Palazzo resorts. (Gary Thompson/Las Vegas Review-Journal)

Sheldon Adelson, chairman and CEO of Las Vegas Sands Corp., left, and Bill Weidner, president and COO of Las Vegas Sands Corp., right, admire a model of the Marina Bay Sands integrated resort on Feb. 8, 2007, in Singapore. The $6 billion resort was completed in 2010 and is an iconic building in the city-island nation. (AP Photo/Wong Maye-E)

Sheldon Adelson, chairman and CEO of Las Vegas Sands Corp., left, and Bill Weidner, president and COO of Las Vegas Sands Corp., right, admire a model of the Marina Bay Sands integrated resort on Feb. 8, 2007, in Singapore. The $6 billion resort was completed in 2010 and is an iconic building in the city-island nation. (AP Photo/Wong Maye-E)

Las Vegas Sands Chairman and CEO Sheldon Adelson speaks at a news conference for the Sands Cotai Central in Macau Wednesday, April 12, 2012. U.S. billionaire Adelson’s Macau casino operator launched on Wednesday its long-delayed fourth resort, a $4.4-billion complex that’s the company’s latest bet on continued strong growth in the world’s biggest gambling market. (AP Photo/Kin Cheung)

Adelson attributed his business success to doing things differently than the way that peers had conventionally done them.

“I came to learn that if you do things differently, success will follow you like a shadow. So that’s what I did,” he said in a 2014 Global Gaming Expo appearance. “People doubted me because people just didn’t do what I would do. Nobody thought about doing it the way I did. They were satisfied with the status quo, and I’m never satisfied with the status quo.”

He enrolled at the City College of New York to study business and finance but later dropped out, joined the Army and served in the Korean War. After returning to the United States, he worked on Wall Street as a court stenographer and began trying his hand at a wide range of ventures, including mortgage brokering, financial advising and real estate investing. He also invested in a number of other companies, including one that published magazines. One of its titles: Data Communications User.

Upon learning that other magazines were sponsoring conventions related to their content, Adelson decided to create a conference specifically for computer dealers. His timing was impeccable; the world of personal computing was just beginning to emerge. Working with partners Robert Lively and Richard Katzeff, Adelson organized the first tech trade show and called it Comdex, a portmanteau of Computer Dealers Exhibition, in 1979. It was held at the original MGM Grand, where Bally’s now stands, with 167 exhibitors and 3,904 attendees.

In its heyday, Comdex was the largest convention Las Vegas had ever seen, with more than 200,000 attendees annually.

In 1995, Adelson and his Comdex partners sold the trade show to a Japanese conglomerate for $862 million, of which Adelson’s share was reported to be $500 million. This was money he leveraged to build The Venetian, but he also set his sights overseas.

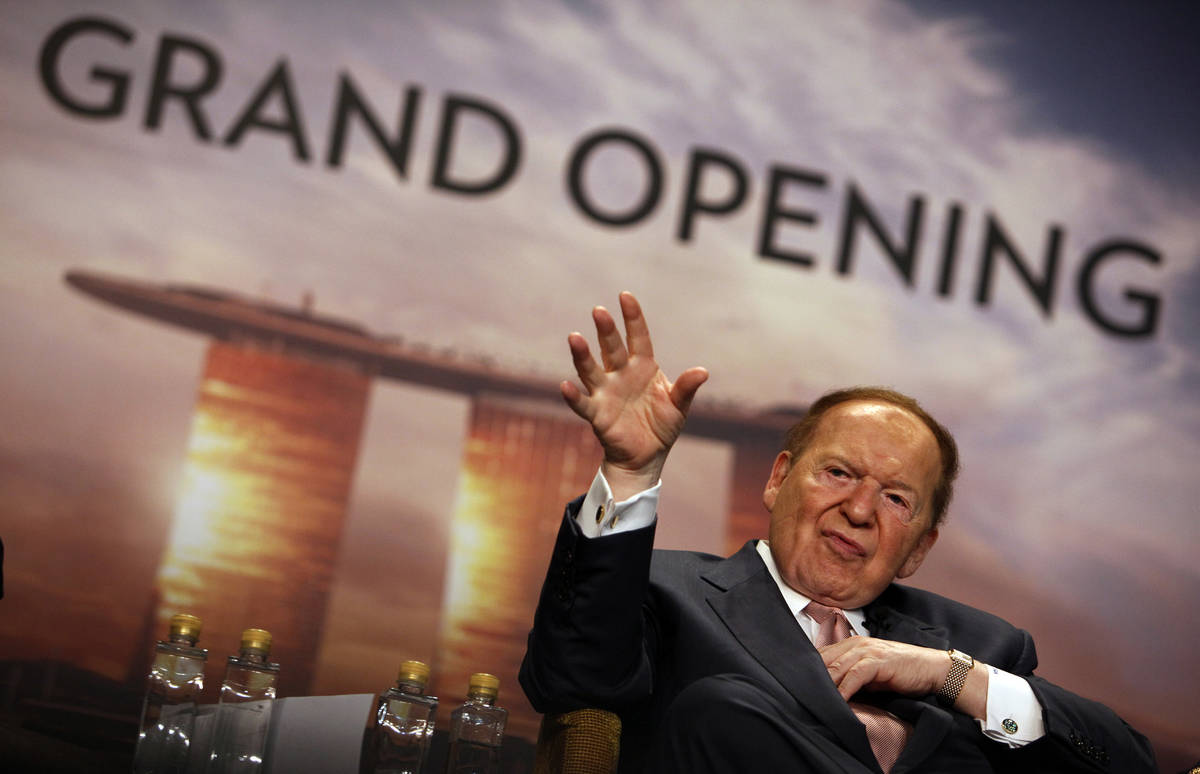

Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson addresses the media during the grand opening ceremony for the Marina Bay Sands in Singapore on Feb. 17, 2011. The massive $6 billion project, Singapore’s second casino, helped turn the Southeast Asian city island-nation into a gambling, tourism and convention destination. (AP Photo/Wong Maye-E)

Macao powerhouse

Las Vegas Sands seized the opportunity when Macao, a former Portuguese colony, was returned to the government of mainland China in 1999.

Gambling was deemed legal in Macao by the Portuguese government in 1849, but the industry had a breakthrough in 1962 when businessman Stanley Ho was granted a monopoly on all forms of gambling. That ended in 2002, when three casino concessions were granted, ending the monopoly. Sands partnered with one of the winning concessionaires and was the first American company to the market, ahead of Wynn Resorts Ltd. and what is now MGM Resorts International.

Sands Macao opened in 2004 in the “Las Vegas of Asia.” The resort was so successful that its first-year profits exceeded the $240 million construction cost of the project, according to industry analysts.

Adelson said he always knew Macao would be a success for the company because the largest American casino companies courted Asian high rollers all the time — and Macao would be much easier to get to than the United States. He also said Asian competitors based in Macao were surprised by his success.

“(The critics) wrongly predicted that I wouldn’t open,” he said in a 2014 interview with Bloomberg. “I’d never get it built, and if I got it built, I wouldn’t open. And if I did open, I’d be in bankruptcy immediately. They didn’t want to believe that somebody else could do something better than they could. They grossly underestimated me.”

The company’s Asian building boom continued in the years following, with the Plaza Macao opening in 2008, the Sands Cotai Central opening in 2012, and the Parisian Macao opening in 2016. The Sands Cotai Central is being renovated and rebranded as The Londoner Macao as part of a multibillion-dollar investment, and it is scheduled to open this month.

The Venetian Macao is shown in 2007, when it opened with the world’s largest casino. (AP Photo/Kin Cheung)

The Venetian Macao is shown in 2007, when it opened with the world’s largest casino. (AP Photo/Kin Cheung)

Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson and his wife, Dr. Miriam Adelson, stand in front of a model of the Sands Cotai Central during a news conference in Macao on April 12, 2012. The company has become the dominant resort operator in the Chinese enclave Macao, the world’s largest gaming market. (AP Photo/Kin Cheung)

Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson and his wife, Dr. Miriam Adelson, stand in front of a model of the Sands Cotai Central during a news conference in Macao on April 12, 2012. The company has become the dominant resort operator in the Chinese enclave Macao, the world’s largest gaming market. (AP Photo/Kin Cheung)

Over the years, Sands has become the market leader in Macao, and Adelson has said on earnings calls with investors that it would continue to be the largest gaming market in the world and a place where the company will invest.

Additionally, the company built the Marina Bay Sands in Singapore, opening the dazzling resort with a park and an infinity pool stretched atop three towers in 2010 at a cost of nearly $6 billion.

Adelson said the design of the Marina Bay Sands occurred because Singapore’s government wanted an iconic building. He suggested a bridge with a pedestrian walkway to access a swimming pool atop the resort. That led to the development of the Sands SkyPark.

“The competition (among resort developers) had an architectural component,” he said in the 2014 Global Gaming Expo appearance. “They said 20 to 30 percent of the decision was going to be made based on architecture. … I do believe in iconic buildings. When we’re competing with other people, you want to have a building that looks nicer than the others. To me, iconic is like the opera house at Sydney, Australia. If you look at a picture, you know exactly the city in which it’s located. That’s an iconic building.”

A $3.3 billion expansion of the property that includes a new tower and a 15,000-seat performance venue is underway.

Forbes recently ranked Adelson as the 38th-richest American, estimating his assets at $35 billion. He owned roughly 57 percent of Las Vegas Sands’ outstanding common stock as of Dec. 31, 2019, according to filings with the U.S. Securities and Exchange Commission.

Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson, left, and presidential candidate Mitt Romney pose for a photograph at the Republican Jewish Coalition’s Winter Leadership Meeting at The Venetian on April 2, 2011, in Las Vegas. (David Becker/Las Vegas Review-Journal)

Political megadonor

As his stature and influence expanded across the globe, Adelson and the company became heavily involved in politics. Originally a Democrat, Adelson began favoring Republican economic policies as his wealth grew.

Adelson generously, but unsuccessfully, funded Republicans challenging Democratic candidates for seats on the Clark County Commission and Nevada’s 1st Congressional District before focusing his formidable firepower on the national political front. Adelson donated to George W. Bush’s re-election campaign in 2004, and he was a principal backer of a conservative political advocacy group called Freedom’s Watch in 2008.

In 2012, he initially backed former House Speaker Newt Gingrich in the GOP presidential primary before falling in behind the party’s nominee, Mitt Romney. He reportedly spent $93 million on the presidential race alone.

That year Adelson wrote an op-ed for The Wall Street Journal headlined “I didn’t leave the Democrats. They left me.” One of his biggest complaints about Democrats was what he described as an emerging anti-Israeli sentiment in the party.

“It’s the choice that, I believe, my old immigrant Jewish neighbors would have made,” he wrote. “They would not have let a few disagreements with Republicans void the importance of siding with the political party that better supports liberal democracies like Israel, the party that better exemplifies the spirit of charity, and the party with economic policies that would certainly be better for those Americans now looking for work.”

In 2016, Sheldon and Miriam Adelson donated $82.5 million to GOP groups. The couple supported Donald Trump and, following his presidential election victory, they also donated $5 million to Trump’s inauguration committee.

The Adelsons ranked as the nation’s top political donors in both the 2018 and 2020 elections, according to the Center for Responsive Politics, directing almost $350 million to Republican candidates during those cycles. The Adelsons and Las Vegas Sands also donated $23.2 million for statewide races in 2018.

“I’m against very wealthy people attempting to or influencing elections,” Adelson once told Forbes. “But as long as it’s doable, I’m going to do it.”

President Donald Trump and Las Vegas Sands Corp. Chairman and CEO Sheldon Adelson address the Israeli American Council National Summit in Hollywood, Fla., on Dec. 7, 2019. (AP Photo/Patrick Semansky)

Israel advocacy, philanthropy

Adelson’s political influence did not stop at U.S. borders. He was widely considered the most generous and most influential contributor to Benjamin Netanyahu’s campaign to win a fourth term as Israel’s prime minister in 2015.

The Adelsons were strong advocates for U.S. recognition of Jerusalem as Israel’s capital and for moving the U.S. Embassy from Tel Aviv to Jerusalem. Trump did both, and the Adelsons were present when the new U.S. Embassy opened in Jerusalem in 2018.

Adelson also has donated generously to causes he cared about. In 2006, the Adelsons donated $25 million to Yad Vashem, the Holocaust shrine in Israel, the largest private donation in its history.

That same year, they created the Dr. Miriam and Sheldon G. Adelson Medical Research Foundation, which has funded hundreds of millions of dollars in groundbreaking research on treatments for cancer, neurological disorders and other diseases. The foundation was born from Sheldon Adelson’s frustration with the slow pace of discovering effective treatments for suffering patients.

“Mr. Adelson found that progress in medical discovery was confounded by secrecy about new scientific findings until journal papers were published or grants were funded, biotechnology owned by industry that was kept out of the hands of academic investigators, and a system that did not encourage risking large scientific steps,” the foundation’s website says. “Bright investigators were living in isolation and spending precious time trying to obtain funds from the traditional government funding sources and foundations, many times competing with their peers for scarce resources.” The foundation funds institutions and researchers who collaborate, pool knowledge and resources and verify each other’s experiments, accelerating the identification of effective treatments.

In 2007, the couple established the Adelson Family Foundation to “strengthen the State of Israel and the Jewish people,” according to its website. Major donations through the foundation have included $50 million for the Dr. Miriam and Sheldon G. Adelson Educational Campus, their private school in Summerlin; $65 million to the medical research branch; and more than $400 million to Birthright Israel, which finances free educational visits to Israel for Jewish teens and young adults. The foundation was believed to be the largest of all donors to Jewish and Israeli causes, giving about $200 million annually.

Adelson often made smaller charitable gestures. Forty U.S. soldiers who had been recuperating from serious war wounds at Walter Reed National Military Medical Center were flown to Las Vegas to spend the 2008 Labor Day weekend in The Venetian’s high-roller luxury suites. Adelson went on to host many other wounded veterans at his Strip hotels as a thank-you for their service.

The company’s Sands Cares corporate-giving program provides money and company volunteers to a variety of causes, from disaster relief after Typhoon Hato struck Macao in 2017 to the Nevada Partnership for Homeless Youth and HELP of Southern Nevada to the ongoing Sands ECO360 global sustainability program.

The exterior lights at The Venetian and Palazzo are turned off in support of Earth Hour on March 28, 2020, in Las Vegas. The Venetian strategically illuminated several guest suites to spell out the word “LOVE” as a tribute to the extraordinary efforts of the medical community worldwide to help protect the public from the coronavirus pandemic. (L.E. Baskow/Las Vegas Review-Journal)

Fighting drug addiction

The Adelsons’ benevolence also focused on helping those fighting drug addiction. The couple opened their first drug abuse clinic in Tel Aviv in 1993. In 2000, the Adelsons opened the Dr. Miriam and Sheldon G. Adelson Clinic for Drug Abuse Treatment and Research in Las Vegas to help treat addiction to opioids and other substances.

In addition to funding drug treatment, the Adelsons have contributed to campaigns to defeat the legalization of medicinal and recreational marijuana. Their mutual passion for fighting illegal drugs stemmed from Miriam Adelson’s medical studies and the loss of Mitchell Adelson, one of Sheldon Adelson’s sons from his marriage to his first wife, Sandra, to a drug overdose in 2005.

In fact, it was Adelson’s dedication to the cause of fighting addiction that convinced then Miriam Farbstein to agree to go on a blind date with the “brash Boston businessman” her friends had suggested might be a good match for her. Farbstein, a physician and Israel native, studied chemical dependency and drug addiction as an exchange student at Rockefeller University in New York.

The date went well. The couple married in Israel in 1991.

“In the three decades since, I doubt that Sheldon and I have spent more than a half-dozen nights apart,” Miriam Adelson wrote in a letter celebrating her husband’s 85th birthday.

Bringing the NFL to Las Vegas

Beyond his own company’s investments on the Las Vegas Strip, Adelson recently influenced another major transformation to the resort corridor skyline: Allegiant Stadium.

Adelson struck the initial partnership with Oakland Raiders owner Mark Davis in 2016 that laid the groundwork for the team’s 2020 move to Las Vegas. Adelson’s promised private financing helped secure the Nevada Legislature’s support for a hotel room tax increase and $750 million in public funding for the $2 billion project.

But Adelson withdrew his promised $650 million commitment in 2017 amid failed negotiations with the Raiders and the NFL and over botched communications involving the stadium’s business plan and lease proposal.

“(The Adelsons) felt (the Raiders) were asking to be entitled to revenue streams and things that simply made the deal unworkable,” Andy Abboud, vice president of government relations and community affairs for Las Vegas Sands Corp., said in 2017. “It was never about the financial return for the Adelsons, but the Adelson family wasn’t going to have their pocket picked, by the Raiders or by the NFL or anybody.”

Nevertheless, Raiders President Marc Badain, Las Vegas Stadium Authority Board Chairman Steve Hill and then-UNLV President Len Jessup all publicly acknowledged that the stadium plan would not have been possible without Adelson’s initial involvement. The Raiders later obtained bank financing to replace Adelson’s investment, and the indoor stadium was completed last summer.

In addition to his wife, Miriam, Sheldon Adelson is survived by three sons, Gary, Adam and Matan Adelson; three daughters, Shelley Adelson, Sivan Dumont (and son-in-law Patrick Dumont) and Yasmin Lukatz ; and 11 grandchildren.

The Review-Journal is owned by the family of Sheldon Adelson.