Understanding Your Real Estate Taxes: Answers from Victoria Sirota, Assessor at Scarsdale

Monday, April 12, 2021 9:22 AM Last updated: Monday, April 12, 2021 9:37 AM Posted: Monday, April 12, 2021 9:22 AM Joanne Wallenstein Hits: 19

Do you have any questions about your property taxes? How does the increase in sales prices affect your taxes? What does the equalization rate mean and will Scarsdale be reevaluated? We asked Scarsdale Village Assessor Victoria Sirota for some answers and here is what we learned.

For the first time in many years, Scarsdale has a 100% compensation rate. Can you explain what that means?

In the simplest case, a compensation rate is a measure of the overall valuation level in relation to the full market value at which a municipality values all of its properties. The compensation rates are calculated annually by the Office of Real Estate Tax Services (ORPTS) valuation staff and are used for a variety of purposes including, but not limited to, district tax sharing and state aid distribution. The compensation rate of 100% set by ORPTS for the evaluation year 2021 is the most current evaluation level from Scarsdale. Since Scarsdale is not considered a parish for annual revaluation, the 100% compensation rate merely reflects an estimate of its market value based on the state’s market measurements. This does not mean that the municipality values real estate at 100% of its market value. As a non-reassessment municipality, the ratings are not reviewed and adjusted annually to reflect the market on a city-wide basis. Therefore, the assessor is not authorized to reevaluate all unequal ratings. As in previous years, the appraiser will use this year’s compensation rate to determine the appraised value of new improvements as well as the market value of a property when conducting a valuation review at the request of the homeowner.

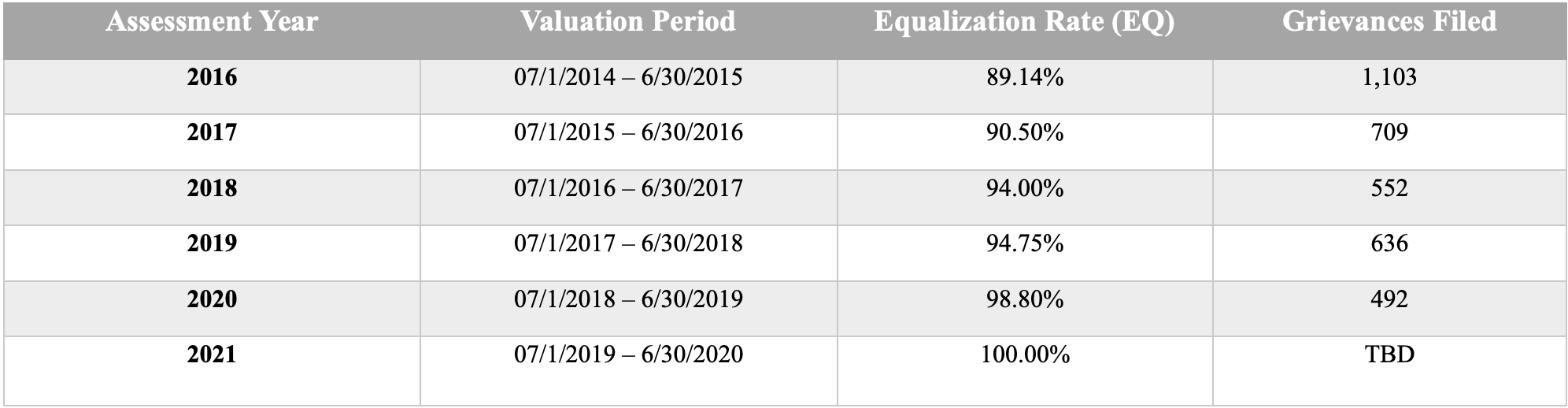

The following graph shows the compensation rate since 2016. Note that an increasing compensation rate means a declining market and vice versa.

How will the hot home sales market affect taxes in Scarsdale?

Property tax is an ad valorem tax, meaning it is based on the value of real estate. In order to collect and collect property taxes, the value of every single property in the city must be determined. This is the job of the assessor. The auditors have no control over taxes because taxes do not depend on the auditor’s role. The taxes are set by the district, school, village and city administrations. It is important to know that Scarsdale does not generate more revenue when the ratings go up because the ratings are sales neutral. If the total estimated value increases and the tax levy remains unchanged, the tax rate would decrease. The ‘hot’ home sales market in Scarsdale highlighted the fact that ratings have become out of date since the last citywide re-rating as the spread between rated values and market values has widened over the past year. This trend is likely to be a consideration for the Board of Trustees when planning the next revaluation project.

When can a house be revalued? After a sale? After renovations?

In a non-revaluation community like Scarsdale, the auditor is bound by strict New York State rules, regulations and procedures that require them to determine the market value of all properties based on annual building permits and review requests. In a re-evaluation municipality, the rules, regulations and procedures differ slightly as the evaluator has additional authority to re-evaluate any disparate evaluations. Under strict state guidelines, reviewers are not allowed to adjust ratings (either up or down) based on the selling price. However, it is the task of the assessor to review the assessments at the request of the homeowner and to reduce them if necessary.

Do you expect Scarsdale to have to re-evaluate on a regular basis or will the grieving process keep the assessments in line with the market?

While review requests allow the auditor to review the valuation of a single property, this process does not create valuation equity and fairness across the community because the auditor is unable to correct all of the dissimilar valuations. For example, if the ratings are below market value, then typically homeowners would not dispute the rating. To ensure that all properties are valued fairly, auditors should conduct periodic revaluations. A revaluation is the comprehensive review and update of all property values in a community. By adjusting the “estimated value” of each property to the full market value, the appraisers do not increase or decrease the property tax for a municipality, but “level out the competitive conditions” so that all properties are valued fairly and only pay their fair share of taxes. It is important to note that if the total estimated value increases and the tax levy remains unchanged, the municipal tax rate would decrease.

Do you expect more / less complaints this year?

As every year, residents are encouraged to speak to their assessor and / or formally challenge their assessment by filing a request for review of the assessment if residents believe their assessment is unjust. Reviewing a review is free and there is no need to hire a lawyer. The body that hears assessment complaints and determines their outcome is the Board of Assessment Review, whose members are appointed by the city administration. Under New York State law, exam complaints may be filed with the Assessor’s Office between June 1 and the third Tuesday of June or June 15 for this year’s legal filing deadline. To reiterate, it is the assessor’s job to ensure that the assessments are fair and equitable and to help the public understand their assessment and, if necessary, adjust it. It is important to remember that taxes cannot be grieved with the auditor, only with assessments. If the property can be sold at full market value for the appraiser’s appraisal, the appraisal is most likely fair.

The graph below shows that the number of complaints submitted has decreased over the past five years.

![]()