- The government of Laos issued Notice 0831 in February 2021, which requires all individuals subject to personal income to obtain a tax identification number (TIN).

- Eligible persons have until June 30, 2021 to receive a TIN. You must register with your local tax district office.

- The regulation is part of the ongoing tax reform in Laos. The country passed a new Income Tax Act in 2020 that sets out the latest tax rates for businesses and employees.

The Laos Ministry of Finance issued Notice 0831 (No. 0831) on February 10, 2021 stating that all individuals subject to income tax, including citizens and foreigners, should apply to their local tax office for a Tax Identification Number (TIN) must register June 30, 2021.

What does the new tax law say?

According to the new regulation, the following groups belong to the persons subject to income tax:

- Public servants;

- Army personnel;

- Police;

- Business people;

- Workers;

- Manpower;

- Technician;

- Consultant;

- Athlete; and

- Retailers among many others.

The aim of the regulation is to protect and monitor income recipients who have fulfilled their tax obligations. In addition, the TIN registrations will help the government build a national personal income database to better collect and analyze government taxes.

Compliance and filing of documents

To register for a TIN, applicants must submit the following documents to their district tax offices:

- Social security number;

- Valid identity card or passport;

- Family registration book;

- All bank account numbers; and

- occupation

Continuation of income tax reforms

The new regulation is part of the government’s ongoing tax reforms. In February 2020, the new Income Tax Act (Tax Act No. 67 / NA) was passed, which sets the latest tax rates for employees and companies.

The new law offers better progressive tax rates and a larger PIT deduction base. The government hopes the latest tax law will improve compliance and productivity in Laos.

Investors are encouraged to use the services of registered tax professionals to better understand these latest tax changes.

Income tax in Laos

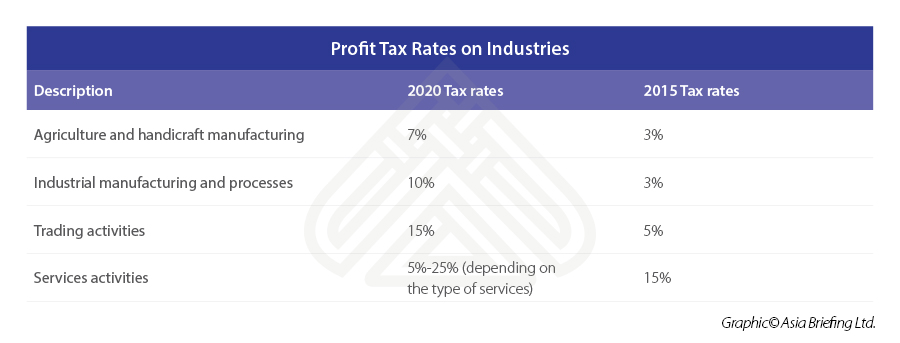

Income tax is levied on the profits of all domestic and foreign companies and is levied on the profits. The rates range from 0 to 20 percent.

Income tax in Laos

The latest progressive tax rates for Laos are:

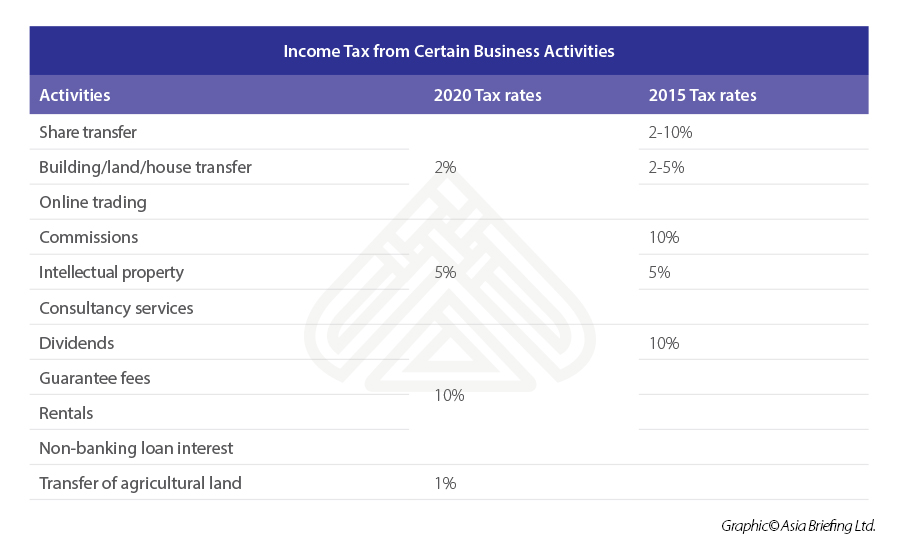

Income tax for selected business activities in Laos

The government has also imposed specific income tax rates on selected business activities.

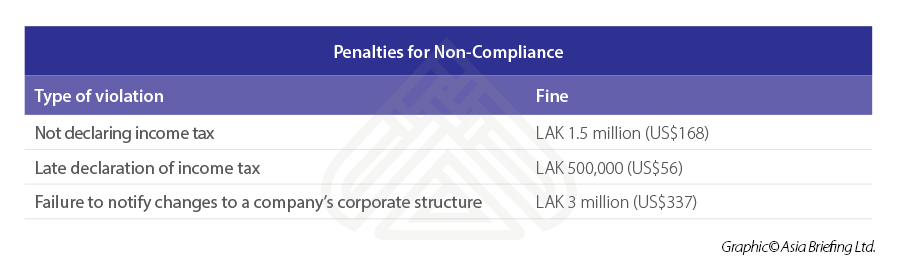

Penalties for Violations

Violations will result in a fine of between LAK 1.5 million (US $ 160) and LAK 3 million (US $ 321). These are highlighted in the table below.

about us

ASEAN Briefing is produced by Dezan Shira & Associates. The company supports foreign investors across Asia and has offices across ASEAN, including Singapore, Hanoi, Ho Chi Minh City and Da Nang in Vietnam, and Batam and Jakarta in Indonesia. We also have partner companies in Malaysia, Bangladesh, the Philippines and Thailand as well as our practices in China and India. Please contact us at [email protected] or visit our website at www.dezshira.com.