For weeks, the tax world has been seething about the G-7 summit and what it could mean for multinational corporations.

G-7 is short for the Group of Seven Nations, a consortium of wealthy industrialized countries that have met regularly since the 1970s to discuss global economic concerns and initiatives. Today the G-7 includes Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States

British Prime Minister Boris Johnson receives heads of state and government from the USA, Japan, Germany, France, Italy and Canada at the G-7 summit.

Photo by Jonny Weeks – WPA Pool via Getty Images.

This month the leaders of these countries met in Cornwall, England for the G7 summit. Those in attendance included hosts Boris Johnson (UK), Justin Trudeau (Canada), Emmanuel Macron (France), Angela Merkel (Germany), Mario Draghi (Italy), Yoshihide Suga (Japan) and Joe Biden (USA). Charles Michel and Ursula von der Leyen were also present as representatives of the European Union; the EU is not a member of the G-7, but usually takes part in the summit.

During the summit, these leaders attended meetings and published joint statements on issues affecting the world economy and other policies such as climate change. And unsurprisingly, a global tax treaty took center stage, with significant interest centered on multinational corporate taxes, transfer pricing, and digital taxes. For more information, see What you need to know about the G-7 tax treaty.

Tax professionals have a lot to keep up with, so we covered you in our Insights Roundup.

Quick Numbers Trivia

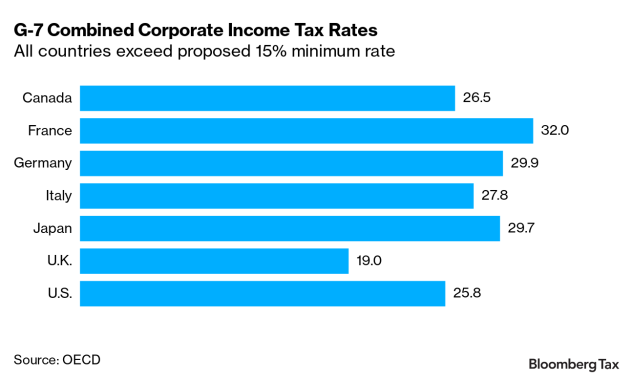

The G-7 has basically agreed on a worldwide minimum corporate tax rate of at least 15% for multinational corporations. How many of the G-7 countries currently have a corporate tax rate greater than 15%?

(Answer below.)

Our summary

It’s important to keep up with global tax movements that affect tax planning, compliance, and enforcement. From minimum tax rates to transfer pricing, our tax experts are talking about it this week.

The G7 finance ministers have announced their support for a minimum global tax of at least 15% and the redistribution of certain profits to large multinational corporations. In the G7 Treasury Secretary’s announcement on Pillars One and Two, Does It Matter ?, Jeff VanderWolk of Squire Patton Boggs looks at the implications.

For more information on the G-7 tax deal, check out this week’s episode of Talking Tax, G-7 tax deal was great, but now comes the hard part.

French President Emmanuel Macron (L) shakes hands with President Joe Biden ahead of a bilateral meeting during the G-7 summit in Carbis Bay, Cornwall, UK on June 12, 2021.

Photo by Ludovic Marin / AFP via Getty Images.

This spring, the US government proposed abolishing the OECD requirement that only automated digital services and consumer-facing businesses should be included in the first pillar, the OECD’s proposal to tax the digital economy. In Part 1 of the two-part article Taxing The Top 100, Lorraine Eden of Texas A&M University shows how the US proposal would create an incentive to regularly restructure multinational companies so that they do not fall into the top 100. In Part 2, Eden shows that the US proposal to use the top 100 multinationals could be impractical because of the regularly changing membership.

The rise of control technology owes much to the development and implementation of AI technology. The digitization of economic transactions on cloud platforms has changed our workplace and our daily lives. The digital economy also brought an unprecedented amount of information that was not previously available to everyone. In Technology for Transfer Pricing, Unilever PLC’s Shan Sun examines the challenges and opportunities these changes bring.

Digital assets present international tax systems with new tax challenges. In Tax Challenges of the New Digital Assets – and their Treatment in Portugal, Rogério M. Fernandes Ferreira of RFF & Associados explains how unique, identifiable digital assets such as non-fungible tokens raise questions and discusses their current treatment in the Portuguese tax framework.

In the local area, domestic businesses are still struggling to recover from the pandemic. Challenges are utilities that continue to make headlines.

The pandemic has required remote working for many businesses where it may only have been an occasional practice. Many employees thought they enjoyed it. Many companies started thinking about cutting their office space costs. In what is your plan? Avoiding Tax Pitfalls for a Remote Worker, Jennifer Weidler Karpchuk and Katherine Noll of Chamberlain Hrdlicka discuss tax considerations and how to plan for an expanded or more permanent remote worker.

The Restaurant Revitalization Fund supports restaurants and other eligible businesses with gross income from the sale of food and beverages. In Key Takeaways of the Restaurant Revitalization Fund, Mazars’ Sofia Cordero explains how the program works and the requirements for participation.

The IRS has issued formal guidelines on employee loyalty credits (ERCs).. In IRS Issues Notices With Updated, Formal Guidance on Employee Retention Credits, Isabelle Farrar, Alec Oveis and Joshua Thomas from Ropes & Gray LLP explain how the loan works and how companies can benefit from both Paycheck Protection Program (PPP) loans and the ERC.

PPP loans have raised many questions for businesses and tax professionals. In a recent episode of Talking Tax, you can find out more about the program’s launch, its future, and efforts to stop the pandemic-fighting fraud.

Write for us

Bloomberg Tax Insights articles are written by tax professionals and provide expert analysis of current tax practice and policy issues, tax trends and issues, and the practice and management of tax and accounting firms. If you have an interesting, unpublished article to publish, we’d love to hear about it. You can contact our Insights team by email at TaxInsights@bloombergindustry.com.

Headlights

This week’s focus is on tax professor Leandra Lederman. Lederman is the William W. Oliver Professor of Tax Law and Director of the Tax Program at Indiana University’s Mason School of Law. As a tax professor, she leads the Indiana / Leeds Summer Tax Workshop Series with Prof. Leopoldo Parada from the University of Leeds. She is also the co-author of books on tax controversy and corporate taxation, has published over 50 articles, and is among the top 10 most cited US tax scholars.

Student writing competition

Think you have what it takes to write Bloomberg Tax Insights? We’re excited about our first Bloomberg Tax Insights writing competition designed to highlight the best in student writing. Due to a large number of new submissions, our deadline has been extended to June 30, 2021.

Run with us

Ready to blow off some steam after a long (long) tax season? It’s not too late to sign up for our virtual 5k. Run as fast as you want – or take a walk to take in the fresh air – and earn a cool medal. And since #TaxTwitter loves their waffles, pancakes and other breakfast foods, we keep paying it by donating the proceeds to World Central Kitchen to fight hunger. Here you can sign up.

Quick number answer

All seven.

Exclusive content for Bloomberg Tax subscribers

As the digital economy evolves into a global economy, historically non-digital companies innovate and create new commercial offerings that have never been seen before. In this special report from Baker McKenzie’s Global Tax Practice, you’ll find an overview of digital technology trends that embrace all non-digital businesses and that interact with the top tax trends that businesses need to actively control. You will also find case studies focusing on healthcare, consumer goods and retail, as well as the broad industrial and manufacturing sectors, as well as an overview of digital-specific international tax and transfer pricing trends.

* Note: Your Bloomberg Tax login is required to read the special report.

More great tax content

This is a practitioner-authored weekend round-up from Bloomberg Tax Insights that includes expert analysis of current tax practice and policy issues. For a full archive of articles, see Daily Tax Report, Daily Tax Report: State, Daily Tax Report: International, Transfer Pricing Report, and Financial Accounting.

You can also follow Bloomberg Tax on Twitter, Facebook, and LinkedIn.

What did you think?

We hope you found Weekend Insights valuable. We’d love to hear your suggestions to make it more enjoyable. Here is our email: TaxInsights@bloombergindustry.com. Thanks for reading!