After Peter Cooper made a fortune selling scrap metal in South Africa, Peter Cooper emigrated to Canada with his sons Marshall and Richard and their families in the mid-1990s.

They settled in Victoria, bought luxury homes, and became permanent residents – and qualified for Canadian health and other social services.

But that also meant they would eventually have to pay tax on their $ 25 million investment income in offshore accounts.

Instead, Peter and his sons signed up for massive offshore tax fraud designed and operated by Canadian accounting firm KPMG in December 2001, and paid virtually no income tax for more than a decade, according to documents filed in the federal court of Canada of the Canadian Finance Court.

Unreported documents obtained from The Fifth Estate of the CBC and Radio-Canada’s Enquête indicate that Peter Cooper and his sons continued to use the system even after they were discovered they were using KPMG’s offshore tax fraud Canadian Treasury Auditors called it a “bill”. that included “deception”.

The KPMG program involved setting up letterbox companies for Canadian multimillionaires and billionaires on the Isle of Man, a dependency of the British Crown in the Irish Sea. A customer would pretend to give his assets away to one of the mailbox companies and then regularly receive tax-free “gifts” back from the income he had earned from investing the money abroad.

The Cooper family declined to comment through their attorney.

Beach goers walk along a tidal dam on the Isle of Man. The CRA said in 2016 that it would review all transfers of funds over $ 10,000 to the UK krona dependency. (Raphael Satter / The Associated Press)

In 2015, Marshall Cooper said KPMG reached out to his family to register for the tax evasion and that questions should be directed to the accounting firm.

At least 25 well-heeled Canadians were involved in the plan.

The Coopers are “just the tip of the iceberg,” said Dennis Howlett, the former head of Canadians for Tax Fairness, a group that campaigns against offshore tax secrecy.

The House of Commons finance committee restarted a long-dormant investigation into the Isle of Man’s shell companies last month after CBC / Radio-Canada reported suspicious unrelated money transfers.

At hearings on KPMG Isle of Man companies in 2016, the Liberal Finance Committee chairman abruptly blocked testimony – before MPs could know how much money the government might have lost in revenue or the names of all KPMG customers behind Shell companies .

Lifestyle “not supported by the reported income”

In the case of Peter Cooper, who died in 2016, documents filed in federal and finance courts state that he had access to more than $ 25 million in assets offshore and a $ 4 million mansion across from the Royal Victoria Yacht Club owned.

Still, the CRA says in court records that he paid little or no income tax between 1999 and 2010.

In 2001, Cooper received a check for $ 250 from a federal government program to help low-income Canadians with heating bills. The documents state that each year from 1999 to 2010, both he and his wife applied for and received GST rebate payments – a tax credit for individuals and families with low or modest incomes.

His sons also benefited from government tax credits, court records show. Richard Cooper requested a home renovation tax credit of $ 9,000 in 2009 and Marshall Cooper paid a total of $ 3,049 in income tax between 2002 and 2011, while receiving tax credits of $ 5,420 over the same period.

At the same time, the Coopers secretly received from their offshore investments from their family assets what KPMG had described as tax-free “gifts”.

At one point, the CRA found that Peter Cooper’s “lifestyle was not supported by the earnings he reported,” according to their court records.

“Part of the plan” deception

For KPMG and the Coopers, everything seemed to come to an abrupt end when CRA auditors discovered the confidential Isle of Man program in 2010.

In 2012, in addition to paying back taxes and interest, the Coopers were fined nearly $ 4 million for what the CRA called “gross negligence.” The agency said the KPMG program was a “sham” and “a sham was part of the plan” to not declare income in Canada and instead label the money as tax-free gifts.

But even though the CRA exposed KPMG’s offshore program, the Cooper family continued to use it for several years without the tax officials noticing, according to documents filed in federal court.

KPMG said in a statement that its Isle of Man tax plan “fully complies with all applicable tax laws”. (CBC)

KPMG said in a statement that its Isle of Man tax plan “fully complies with all applicable tax laws”. (CBC)

“The expectation was that after the 2012 reassessments they would be compliant, but they say they decided against it,” the CRA said on the court files.

Court documents show that in late 2015, the Cooper family finally admitted – after firing KPMG’s in-house attorney as legal counsel – that they continued to report hundreds of thousands of dollars in capital gains from the Isle of Man between 2011 and 2014.

“I’m not surprised,” Howlett said. “The rich can play this game … it’s about how far you can skate the line and not get caught.”

The Cooper family applied for amnesty for punishment

Court documents show that the Coopers made their admission to the CRA in the hope of qualifying for the so-called Voluntary Disclosure Program or VDP. The program was set up by the CRA to provide amnesty to those who volunteer, declare unreported income, and agree to repay taxes.

The documents indicate that the CRA rejected the Cooper family’s VDP application because it was under review for the Isle of Man program for the 2002-2010 tax years.

The Coopers appealed the CRA’s decision, but eventually withdrew that lawsuit and instead focused on challenging the tax authority’s decision to impose gross negligence penalties of $ 4 million on their undeclared income prior to 2010.

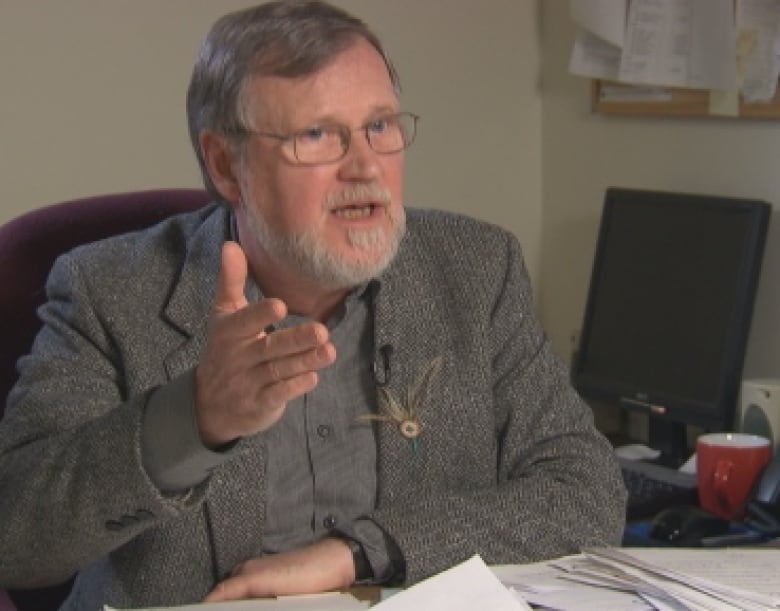

Dennis Howlett, former head of Canadians for Tax Fairness, says the latest revelations about KPMG’s tax system show rich people are playing a game of how far off the line you can skate and not get caught. (CBC)

Dennis Howlett, former head of Canadians for Tax Fairness, says the latest revelations about KPMG’s tax system show rich people are playing a game of how far off the line you can skate and not get caught. (CBC)

Finally, in 2019, the CRA agreed to a secret out-of-court settlement with the Coopers. It is not clear whether the agency has agreed to grant the amnesty they seek to the Victoria family.

The CRA has stated that it will not discuss any specific cases.

In a 2015 interview, Marshall Cooper asked CBC / Radio-Canada to speak to KPMG’s attorney who had been providing him with accounting and legal advice since “Day 1”.

“I’m getting drawn in and I think I shouldn’t have done it at all,” he said.

KPMG did not answer questions about the advice the Cooper family gave after the CRA discovered they were using the Isle of Man program, citing customer confidentiality.

In an email response to CBC, the accounting firm said its tax plan was “fully compliant with all applicable tax laws” and had been reviewed by a law firm in Canada and another in the Isle of Man prior to implementation. KPMG also said the CRA is settling the “vast majority” of tax cases out of court.

KPMG tax partner Greg Wiebe testified before the Commons finance committee in 2016. (ParlVu)

KPMG tax partner Greg Wiebe testified before the Commons finance committee in 2016. (ParlVu)

Laval University tax law professor André Lareau said there should have been a full broadcast of the issues behind the Cooper case in a public forum.

“This would have been a perfect case to prosecute him in court,” he told CBC / Radio-Canada. “There should have been a process, both for the taxpayers in question and for the accounting firm.”

According to Isle of Man public company records and Canadian court documents, KPMG continued to be involved in and benefited from its offshore program long after it last implemented the 2003 tax plan.

And documents filed by the CRA in federal court in the Cooper case state that additional annual fees were charged based on the annual amount of tax evaded by the family.

Last month, KPMG’s new tax chief Lucy Iacovelli also testified before the finance committee about the Isle of Man program.

“The last time we offered it was in 2003,” she testified. “We didn’t manage the structure after that time.”

As chairman of the finance committee, Liberal MP Wayne Easter blocked testimony during the KPMG tax fraud hearings in 2016. (CBC)

As chairman of the finance committee, Liberal MP Wayne Easter blocked testimony during the KPMG tax fraud hearings in 2016. (CBC)

KPMG said it was involved in another “implementation” on behalf of a client that the auditing firm hired in 2007.

CBC / Radio-Canada found two other companies in the Isle of Man in 2009, Semanque and Carluc, with similar characteristics to the Coopers shell company, including the articles of association and one of the company’s directors. KPMG has not specifically addressed these two companies or what they are used for.

In addition to the Coopers’ shell company, CBC / Radio Canada learned that several other shell companies from the KPMG Isle of Man remained active for years after the CRA uncovered the plan in 2010. A company called Parrhesia was officially wound up earlier this year.

While CBC / Radio-Canada identified nine real owners of the more than two dozen letterbox companies that KPMG co-founded, most of the multimillionaires and billionaires involved in the tax evasion are still unknown.