Joe Biden has vowed to take big tech and tax breaks should he win the US president’s race in November, but analysts and legal experts note that current global uncertainties could prevent the Democratic challenger from taking Silicon Valley in the short term to shake up.

Biden has pledged to raise the corporate tax rate from 21% to 28%, reversing some of the tax cuts made under the Trump administration. The former vice president also wants Establishing a minimum tax of 15% on company book earnings or profits reported to shareholders and increasing taxes on foreign profits of US companies based overseas – two policies that directly affect the US technology sector.

In particular, Biden has criticized Amazon.com Inc. and others Big tech companies that don’t pay higher taxes and claim that his proposals will tighten these companies more accountable current Loopholes. While experts note that tech giants may be best equipped to accept a future tax hike, they say prioritizing tax reform could be difficult given the current and ongoing partisan partisanism Coronavirus Pandemic.

A higher corporate tax rate

Biden’s proposal to raise the statutory corporate tax rate to 28% is in stark contrast to the Trump administration’s 2017 US tax overhaul, which lowered the corporate tax rate from 35% to 21%.

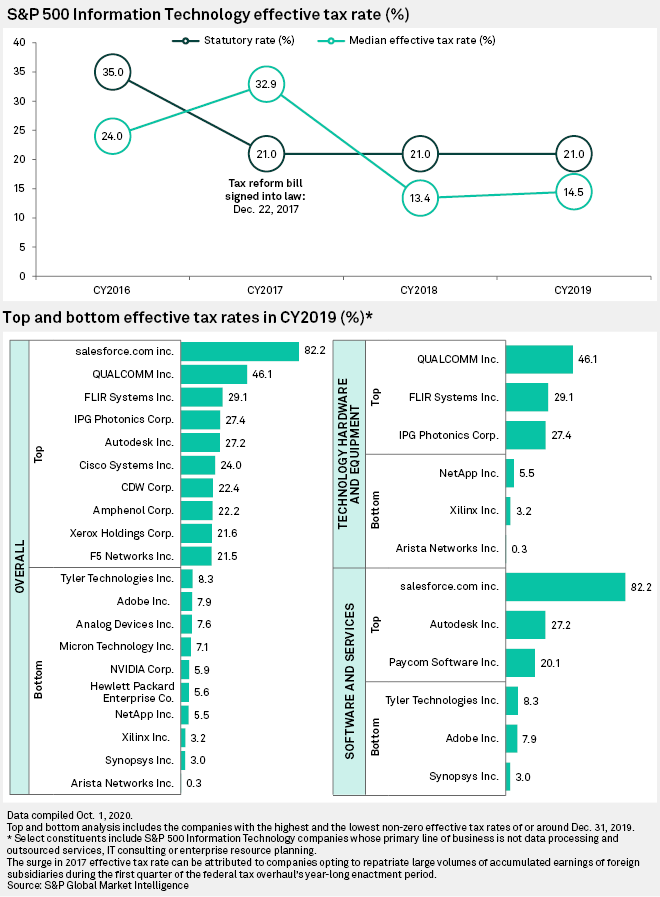

However, it is unclear how much the increase proposed by Biden will affect tech firms, given that the tech sector is notorious for having an effective tax rate that is well below the statutory tax rate, or the percentage set by federal law. Businesses report their effective tax rate as a calculated number that includes federal, state, local, and foreign taxes, as well as various tax breaks.

Overall, information technology companies reported an average effective tax rate of 14.5% for 2019 in the S&P 500, 650 basis points below the statutory tax rate of 21%. For 2016, the companies reported an effective tax rate of 24.0%, 1,100 basis points below the statutory tax rate of 35%.

But it’s the largest US tech companies that own FAANG or FAAMG shares – Facebook Inc., Apple Inc., Amazon, Netflix Inc. or Microsoft Corp. and Alphabet Inc.‘s Google LLC – which have received the most attention for their tax rates.

Of this group, Facebook was the only company to report an effective tax rate at or above the statutory rate in 2019. Netflix and Microsoft reported the lowest effective tax rates last year at 9.5% and 10.2%, respectively.

Cash and Overseas Income

In the past, these tech companies have kept their taxes low by stocking up on overseas profits rather than repaying those funds.

Prior to the 2017 tax reform, a 35% tax was levied on returned cash with a foreign income tax credit, and foreign funds would only be taxed if companies had opted for repatriation. As a result, companies kept their cash overseas, with Apple and Microsoft holding more than 90% of their cash holdings in overseas holdings.

The 2017 legislation shifted U.S. tax law towards a quasi-territorial system by removing the 35% tax on repatriated dividends and introducing a one-time repatriation tax on previously accrued overseas funds. The one-time tax is 15.5% on cash and 8% on non-cash assets payable over an 8-year period.

Apple said it had planned to repatriate the majority of its cash overseas and estimated on its Form 10-K for 2018 that it would be subject to repatriation taxes of approximately $ 37.3 billion paid in installments. Microsoft also had an estimated net charge of $ 13.7 billion in fiscal 2018 for repatriation of cash on hand.

CONTINUE READING: Sign up for our weekly election newsletter here and read our latest coverage here.

GILTI as calculated

To deter US-based multinational corporations from moving future US profits to low-tax areas, the 2017 law also established a US Minimum Tax Rate on Global Low Intangible Tax Income (GILTI) with a base rate of 10.5% and a high tax exclusion rate of 18.9%.

According to the former Vice President’s website, Biden has proposed raising this minimum foreign income rate from 10.5% to 21% in an attempt to “end the global race that rewards global tax havens.”

Daniel Bunn, vice president of global projects at the Tax Foundation, an independent not-for-profit tax policy, said the 2017 tax reform act, even taking into account the one-time repatriation tax and GILTI, made US tax laws “far more agnostic” about where businesses do their earnings Income.

“The point of a territorial system is to say, ‘Multinational corporations, you can operate and invest wherever you want. We take care of your activities here, but we want you to be successful on a global scale against your foreign competitors ‘”Bunn said.

Bunn’s policy, according to Bunn, is the opposite.

“It’s not like we want US multinationals to be successful all over the world. No, we want US multinationals to invest in the US, and if they have overseas operations we will tax them more heavily as their foreign competitors and we will punish their offshore activities for companies, “Bunn said of Biden’s proposals.

Read his lips: No 0% taxes

Biden has also proposed a minimum 15% tax on book income, “so no company can get away with not paying taxes,” according to his website.

In a CNBC interview in May, Biden was asked about antitrust measures against Amazon. He responded by saying, “I think Amazon should start paying their taxes.”

Amazon reported an effective tax rate of 17.0% for 2019, but that includes state and international taxes. Domestically, Amazon reported $ 162 million in current federal taxes in 2019, compared to a pre-tax profit of $ 13.9 billion, a tax rate of around 1.2%.

Biden’s comment likely relates to Amazon’s tax bills for 2017 and 2018, when the company received federal refunds of $ 137 million and $ 129 million, respectively, partly due to a combination of tax credits and withholding.

In response to previous criticism, Amazon said in a January 2020 blog post that it was complying with all applicable federal and state tax laws. “Our US taxes reflect our continued investments, employee compensation and current tax regulations,” the company said.

Greg Valliere, chief US policy strategist at wealth management firm AGF Investments, said in a recent report that while he has been paying much attention to regulatory and antitrust concerns in the US tech industry, he sees the potential for higher tax rates around “the most successful disrupting” and innovative industries in American history. “

“It’s hard to imagine these companies going out of business. We believe an imminent threat to the industry is an aggressive new minimum tax that could be in place within a year if Joe Biden wins the presidency,” wrote Valliere. “This is the real threat, not a cartel attack that could take years to achieve.”

Timed coordination

In terms of timing, Biden said in September that he will reverse the Trump administration’s tax reform on “day one” of his presidency.

However, Eric Toder – a fellow institute and co-director of the Tax Policy Center who has held various senior positions in tax policy offices in the U.S. government and abroad – notes that given the possibility of another resurgence of the confirmed COVID- In 19 cases and Biden’s desire to carry out additional reforms, such as health care and infrastructure investments, may not make tax reform a top priority.

“If Biden gets into a very depressed economy, it is unlikely that he will implement his tax hikes immediately,” Toder said in an interview.

Toder noted that the political make-up of Congress during a Biden presidency will have further implications for how easy or difficult it will be to revise current tax legislation.

But even if Republicans were to retain control of the Senate under a Biden administration, Isaac Boltansky, an analyst for Compass Point Research & Trading, believes there are important parts of Biden’s tax proposals that could still become law.

“In that scenario, the book income tax they are talking about is much more likely. It’s pretty simple, you only have a minimum tax on certain businesses. And I think it’s difficult even for a Republican to push Amazon back when they have to pay one higher tax ” Boltansky said.